Question: 1- What accounting events trigger changes in the retained earnings account? Explain 2- Explain the differences between cash flows from operating, financing, and investing activities.

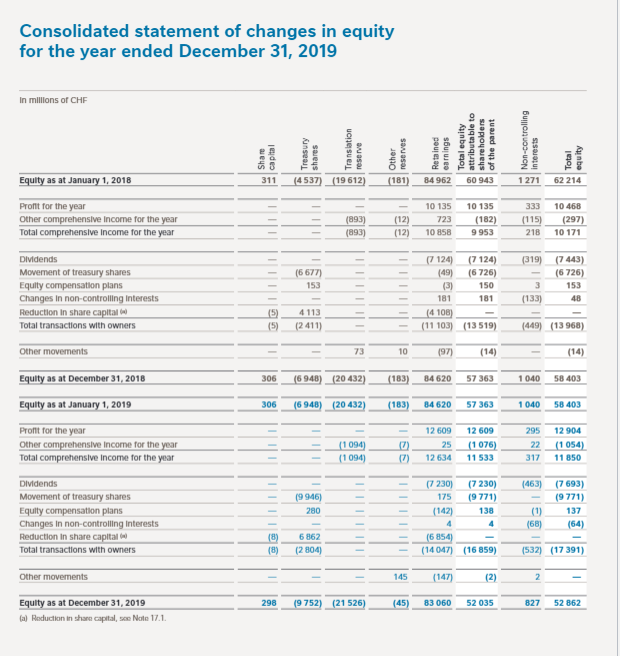

1- What accounting events trigger changes in the retained earnings account? Explain

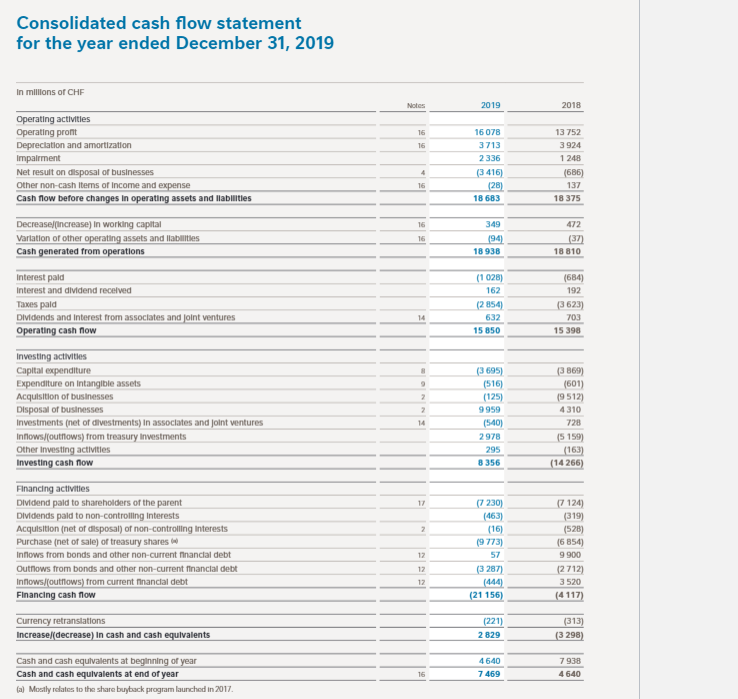

2-Explain the differences between cash flows from operating, financing, and investing activities. You have to use as a basis the statement of cash flows presented

3- If a company increases its accounts payable compared to the previous year, what will be the effect on the cash account? Explain

4-How do increases in fixed assets from one period to the next affect the cash account? Explain

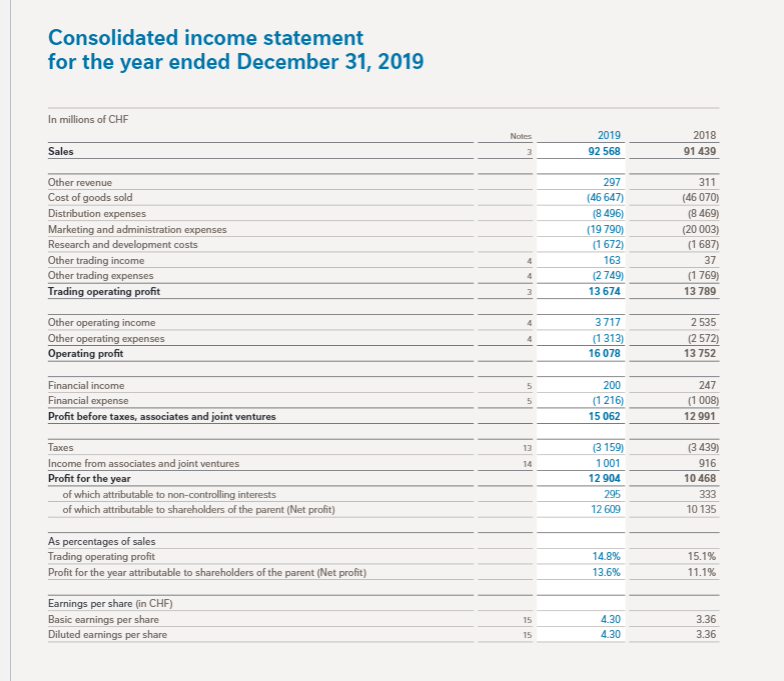

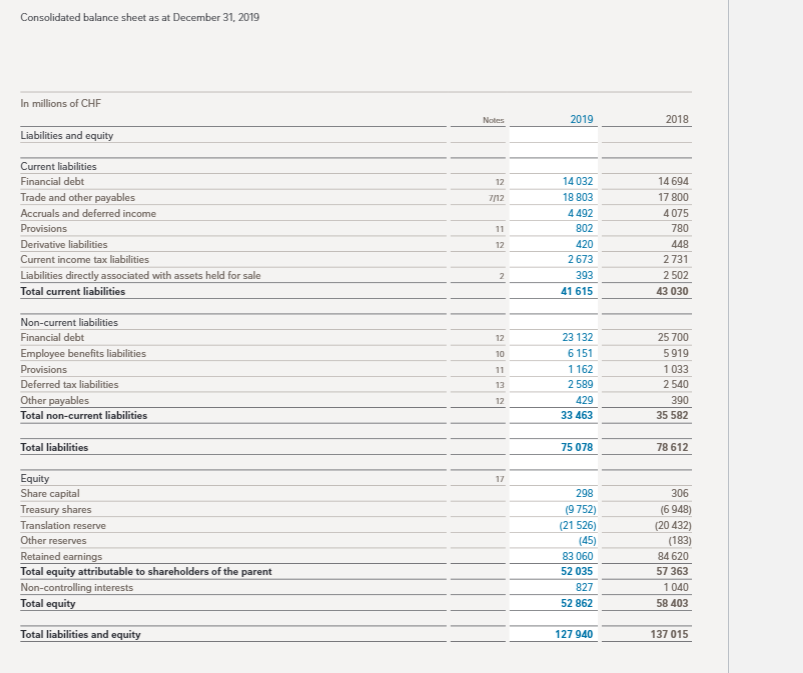

Consolidated balance sheet as at December 31, 2019 In millions of CHF Notes 2019 2018 Liabilities and equity 12 7112 Current liabilities Financial debt Trade and other payables Accruals and deferred income Provisions Derivative liabilities Current income tax liabilities Liabilities directly associated with assets held for sale Total current liabilities 11 14032 18 803 4492 802 420 2673 393 41 615 14 694 17 800 4075 780 448 2 731 2 502 43 030 12 2 12 10 Non-current liabilities Financial debt Employee benefits liabilities Provisions Deferred tax liabilities Other payables Total non-current liabilities 11 23 132 6151 1 162 2589 429 33 463 25700 5919 1 033 2 540 390 35 582 13 12 Total liabilities 75 078 78 612 17 Equity Share capital Treasury shares Translation reserve Other reserves Retained earnings Total equity attributable to shareholders of the parent Non-controlling interests Total equity 298 (9752) (21 526) (45) 83 060 52 035 827 52 862 306 (6 948) (20 432) (183) 84620 57 363 1 040 58 403 Total liabilities and equity 127 940 137 015 Consolidated balance sheet as at December 31, 2019 In millions of CHF Notes 2019 2018 Liabilities and equity 12 7112 Current liabilities Financial debt Trade and other payables Accruals and deferred income Provisions Derivative liabilities Current income tax liabilities Liabilities directly associated with assets held for sale Total current liabilities 11 14032 18 803 4492 802 420 2673 393 41 615 14 694 17 800 4075 780 448 2 731 2 502 43 030 12 2 12 10 Non-current liabilities Financial debt Employee benefits liabilities Provisions Deferred tax liabilities Other payables Total non-current liabilities 11 23 132 6151 1 162 2589 429 33 463 25700 5919 1 033 2 540 390 35 582 13 12 Total liabilities 75 078 78 612 17 Equity Share capital Treasury shares Translation reserve Other reserves Retained earnings Total equity attributable to shareholders of the parent Non-controlling interests Total equity 298 (9752) (21 526) (45) 83 060 52 035 827 52 862 306 (6 948) (20 432) (183) 84620 57 363 1 040 58 403 Total liabilities and equity 127 940 137 015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts