Question: 1. What am I doing wrong with standard cost? 2. Variable Overhead Variances Marshfield Tax Company considers 8,000 direct labor hours or 400 tax returns

1.

What am I doing wrong with standard cost?

2.

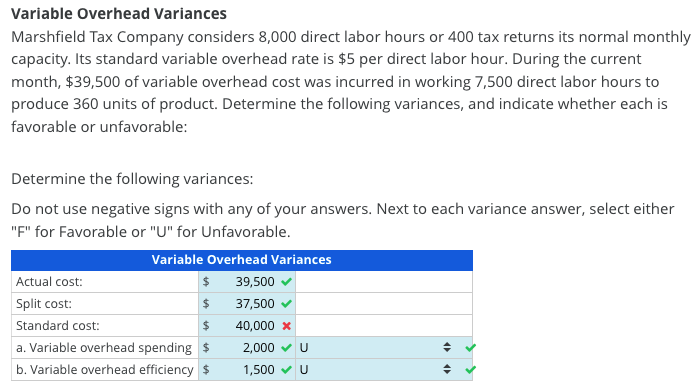

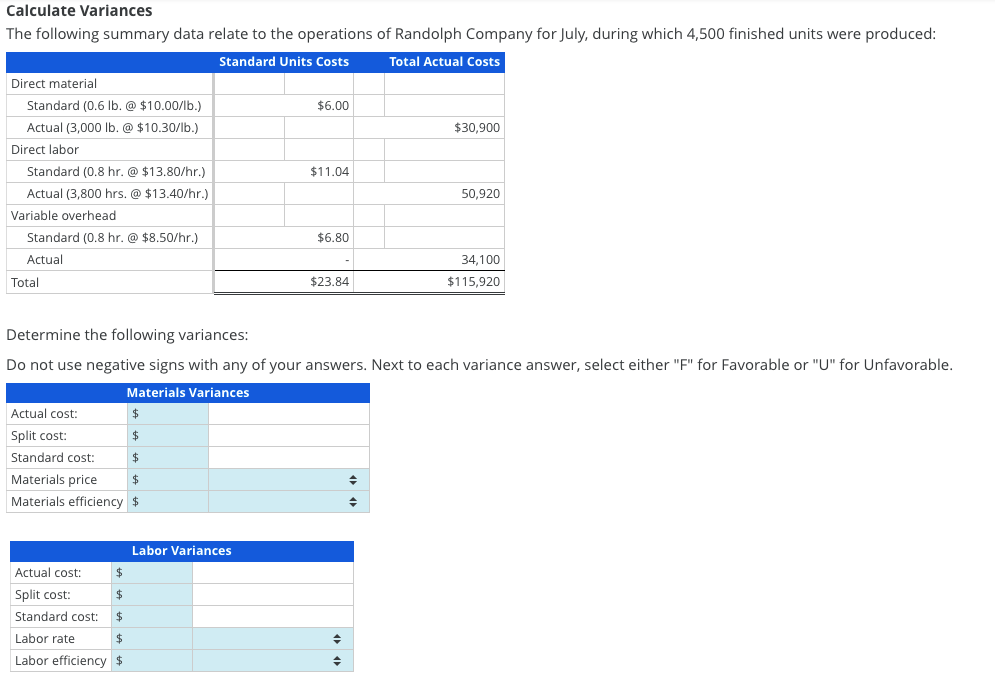

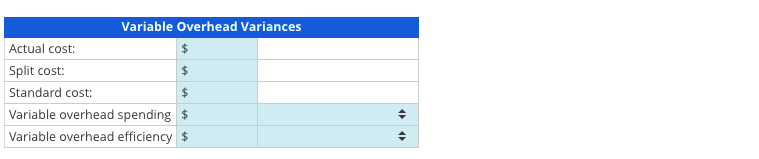

Variable Overhead Variances Marshfield Tax Company considers 8,000 direct labor hours or 400 tax returns its normal monthly capacity. Its standard variable overhead rate is $5 per direct labor hour. During the current month, $39,500 of variable overhead cost was incurred in working 7,500 direct labor hours to produce 360 units of product. Determine the following variances, and indicate whether each is favorable or unfavorable: Determine the following variances: Do not use negative signs with any of your answers. Next to each variance answer, select either "F" for Favorable or "U" for Unfavorable. Variable Overhead Variances Actual cost: $ 39,500 Split cost: $ 37,500 Standard cost: $ 40,000 x a. Variable overhead spending $ 2,000U b. Variable overhead efficiency $ 1,500 U Calculate Variances The following summary data relate to the operations of Randolph Company for July, during which 4,500 finished units were produced: Standard Units Costs Total Actual Costs Direct material Standard (0.6 lb. @ $10.00/lb.) $6.00 Actual (3,000 lb. @ $10.30/lb.) $30,900 Direct labor Standard (0.8 hr. @ $13.80/hr.) $11.04 Actual (3,800 hrs. @ $13.40/hr.) 50,920 Variable overhead Standard (0.8 hr. @ $8.50/hr.) $6.80 Actual 34,100 Total $23.84 $115,920 Determine the following variances: Do not use negative signs with any of your answers. Next to each variance answer, select either "F" for Favorable or "U" for Unfavorable. Materials Variances Actual cost: $ Split cost: $ Standard cost: $ Materials price $ Materials efficiency $ . Labor Variances Actual cost: Split cost: $ Standard cost: $ Labor rate $ Labor efficiency $ Variable Overhead Variances Actual cost: $ Split cost: $ Standard cost: $ Variable overhead spending $ Variable overhead efficiency $ .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts