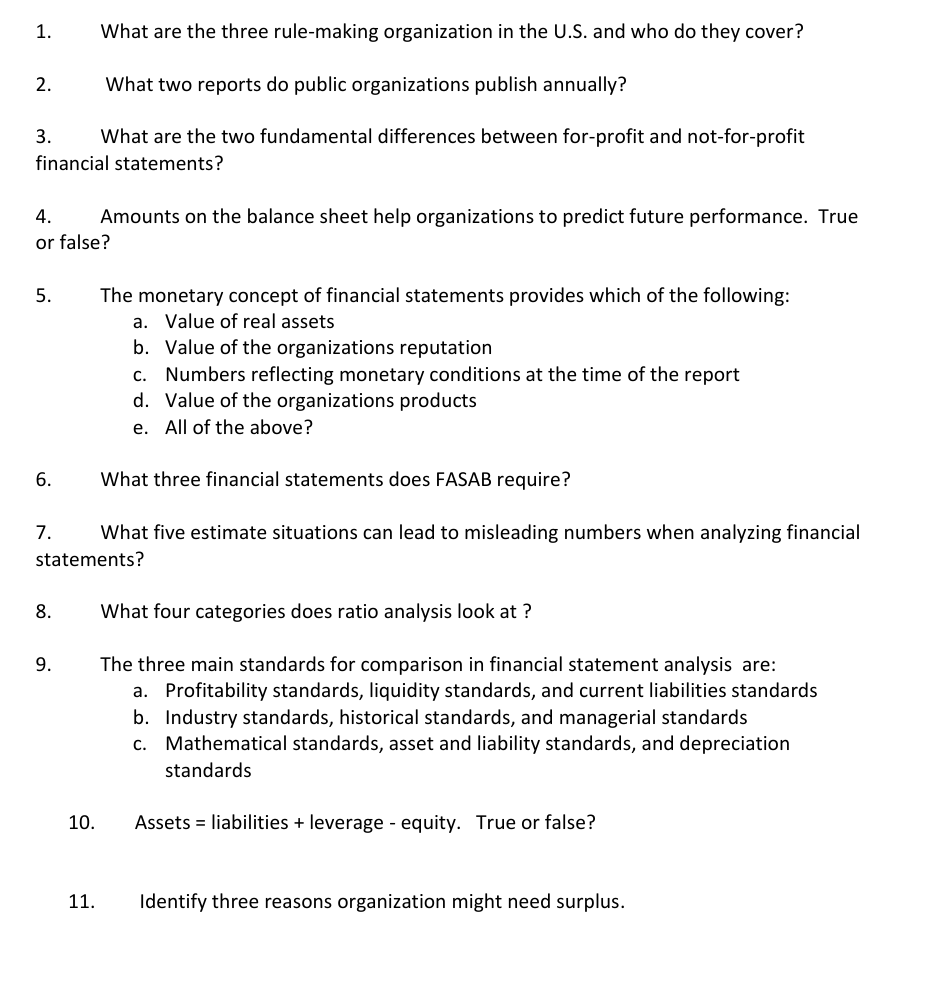

Question: 1 . What are the three rule - making organization in the U . S . and who do they cover? 2 . What two

What are the three rulemaking organization in the US and who do they cover? What two reports do public organizations publish annually? What are the two fundamental differences between forprofit and notforprofit financial statements? Amounts on the balance sheet help organizations to predict future performance. True or false? The monetary concept of financial statements provides which of the following: a Value of real assets b Value of the organizations reputation c Numbers reflecting monetary conditions at the time of the report d Value of the organizations products e All of the above? What three financial statements does FASAB require? What five estimate situations can lead to misleading numbers when analyzing financial statements? What four categories does ratio analysis look at The three main standards for comparison in financial statement analysis are: a Profitability standards, liquidity standards, and current liabilities standards b Industry standards, historical standards, and managerial standards c Mathematical standards, asset and liability standards, and depreciation standards Assets liabilities leverage equity. True or false? Identify three reasons organization might need surplus.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock