Question: 1. What differences would you expect to find between a convenience store and a car dealership, in terms of net profit margin and total asset

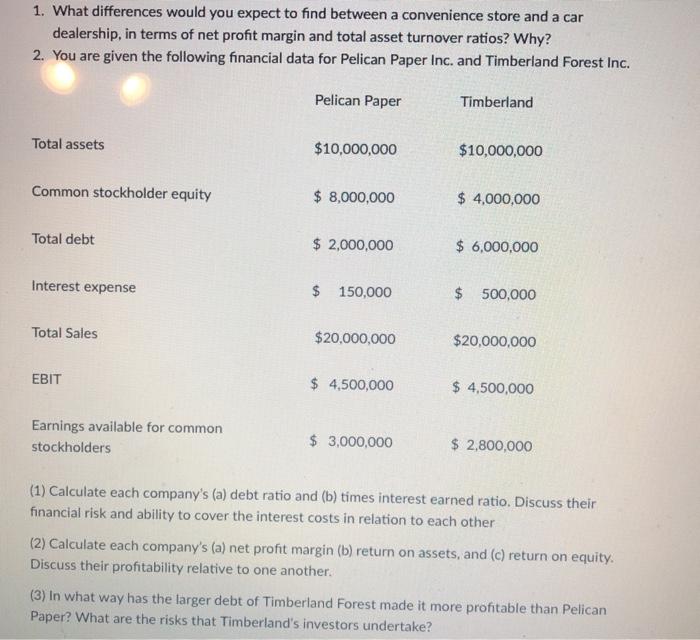

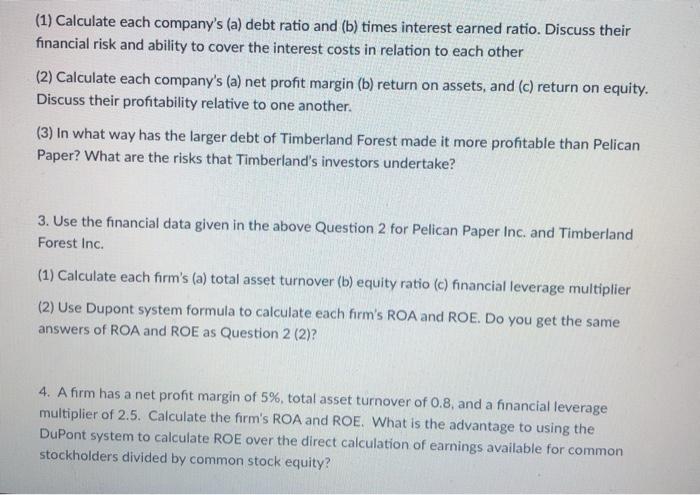

1. What differences would you expect to find between a convenience store and a car dealership, in terms of net profit margin and total asset turnover ratios? Why? 2. You are given the following financial data for Pelican Paper Inc. and Timberland Forest Inc. Pelican Paper Timberland Total assets $10,000,000 $10,000,000 Common stockholder equity $ 8,000,000 $ 4,000,000 Total debt $ 2,000,000 $ 6,000,000 Interest expense $ 150,000 $ 500,000 Total Sales $20,000,000 $20,000,000 EBIT $ 4,500,000 $ 4,500,000 Earnings available for common stockholders $ 3,000,000 $ 2,800,000 (1) Calculate each company's (a) debt ratio and (b) times interest earned ratio. Discuss their financial risk and ability to cover the interest costs in relation to each other (2) Calculate each company's (a) net profit margin (b) return on assets, and (c) return on equity. Discuss their profitability relative to one another. (3) In what way has the larger debt of Timberland Forest made it more profitable than Pelican Paper? What are the risks that Timberland's investors undertake? (1) Calculate each company's (a) debt ratio and (b) times interest earned ratio. Discuss their financial risk and ability to cover the interest costs in relation to each other (2) Calculate each company's (a) net profit margin (b) return on assets, and (c) return on equity. Discuss their profitability relative to one another. (3) In what way has the larger debt of Timberland Forest made it more profitable than Pelican Paper? What are the risks that Timberland's investors undertake? 3. Use the financial data given in the above Question 2 for Pelican Paper Inc. and Timberland Forest Inc. (1) Calculate each firm's (a) total asset turnover (b) equity ratio (c) financial leverage multiplier (2) Use Dupont system formula to calculate each firm's ROA and ROE. Do you get the same answers of ROA and ROE as Question 2 (2)? 4. A firm has a net profit margin of 5%, total asset turnover of 0.8, and a financial leverage multiplier of 2.5. Calculate the firm's ROA and ROE. What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts