Question: 1- What do we calculate using this formula: Value of the bond when dividends are expected to grow at a constant rate None of the

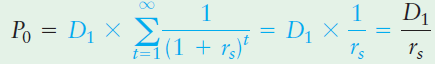

1- What do we calculate using this formula:

Value of the bond when dividends are expected to grow at a constant rate

None of the answers

Effective interest rate for monthly compounding

Value of a coupon bond

Price of the stock when dividends are expected to grow at a constant rate

Value of a preferred stock

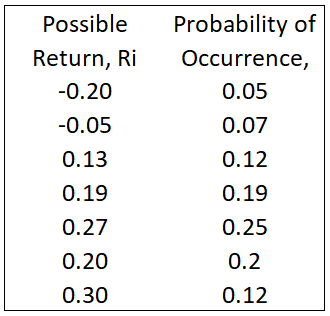

2- Suppose that your estimates of the possible one-year returns from investing in the common stock of the XYZ Corporation were as it is shown below. What is the standard deviation and Coefficient of variation (CV) based on below data?:

St.Dev -16.89%; CV - 2.12

St.Dev -12.28%; CV - 0.45

St.Dev -16.89%; CV - 1.15

St.Dev -6.32%; CV - 0.23

St.Dev -18.24%; CV - 3.26

St.Dev - 12.28%; CV - 0.68

None of the Answers

3- WBS Company currently pays a dividend of $1.70 per share on its common stock. The company expects to increase the dividend at a 17% annual rate for the rst three years and at a 12% rate for the next four years, and then grow the dividend at a 7% rate thereafter. This phased-growth pattern is in keeping with the expected life cycle of earnings. You require a 16% return to invest in this stock. What value should you place on a share of this stock?

26.53

None of the answers is correct

18.33

33.15

35.03

28.48

4- If the expected returns of two investments are different, which would be better measure for riskiness of those investments:

1 point

Beta

Coefcient of Variation

Standard Deviation

None of the answers

Variance

Covariance

5- Return of an individual investment is:

Income received on an investment plus any change in market price, usually expressed as a percentage of the last market price of the investment

Income (cash distributions) received on an investment plus any change in market price, usually expressed as a percentage of the beginning market price of the investment

A statistical measure of the variability of a distribution around its mean. It is the square root of the variance

The weighted average of possible returns, with the weights being the probabilities of occurrence.

A set of possible values that a random variable can assume and their associated probabilities of occurrence.

None of the answers

6- What do we calculate using this formula:

Value of a Zero-Coupon Bond

Price of the bond when dividends are expected to grow at a constant rate

Price of a preferred stock

Value of the stock when dividends are expected to grow at a constant rate

Price of a coupon bond

Effective interest rate for semiannual compounding

D1 Po = Dz x II 1 1(1 + r) 1 D, X rs I's Possible Return, Ri -0.20 -0.05 Probability of Occurrence, 0.05 0.07 0.12 0.19 0.25 0.13 0.19 0.27 0.20 0.2 0.30 0.12 V=D,/(k. - g)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts