Question: 1. What happened in Pennell's fund when the $0.59 per dollar of investment was distributed to LPs? a. To the ongoing management fee due

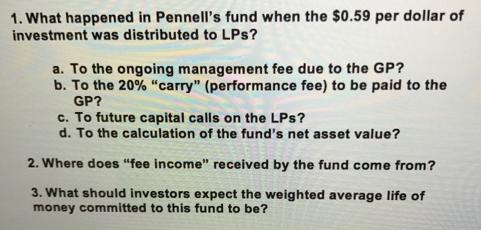

1. What happened in Pennell's fund when the $0.59 per dollar of investment was distributed to LPs? a. To the ongoing management fee due to the GP? b. To the 20% "carry" (performance fee) to be paid to the GP? c. To future capital calls on the LPs? d. To the calculation of the fund's net asset value? 2. Where does "fee income" received by the fund come from? 3. What should investors expect the weighted average life of money committed to this fund to be?

Step by Step Solution

There are 3 Steps involved in it

059 per dollar is a high amount Hence correct option is b To the 20 carry ... View full answer

Get step-by-step solutions from verified subject matter experts