Question: 1) What interest rate compounded quarterly would turn $170 beginning of the month payments over 10 years into a future value of $45,457.52? 2) A

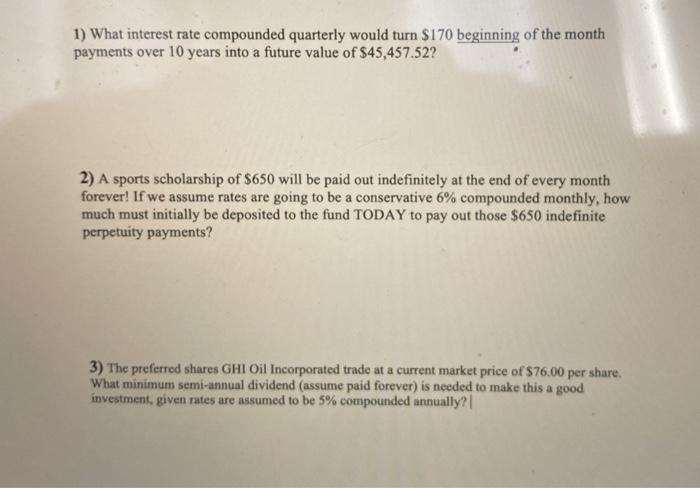

1) What interest rate compounded quarterly would turn $170 beginning of the month payments over 10 years into a future value of $45,457.52? 2) A sports scholarship of $650 will be paid out indefinitely at the end of every month forever! If we assume rates are going to be a conservative 6% compounded monthly, how much must initially be deposited to the fund TODAY to pay out those $650 indefinite perpetuity payments? 3) The preferred shares GHI Oil Incorporated trade at a current market price of $76.00 per share. What minimum semi-annual dividend (assume paid forever) is needed to make this a good investment, given rates are assumed to be 5% compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts