Question: 1 . What is a common proxy for risk free rate? ( 3 ) 2 . State briefly the market efficiency idea. Which form of

What is a common proxy for risk free rate?

State briefly the market efficiency idea. Which form of Market efficiency do you believe in and why?

Given an interest rate of zero percent, what will be the

future value of a lump sum invested today?

As interest rate increases, what happens to the future value

of a dollar? To a present value of a dollar?

What would you prefer to get: a $ compounded for

three years, b $ annuity compounded for three years,

c the present value of $ received after three years?

How many different stocks would you recommend to keep

in a portfolio and why?

What is a typical size of a standard deviation in a well

diversified portfolio and what is the underlying factor that

determines it

You are considering investing in one of these three stocks:

If you are a strict risk minimizer, you would choose Stock

if it is to be held in isolation and Stock

if it is to be

held as part of a welldiversified portfolio.

Joel Foster is the portfolio manager of the SF Fund, a $

million hedge fund that contains the following stocks. The

required rate of return on the market is and the

riskfree rate is What rate of return should investors

expect require on this fund?

Returns for the Alcoff Company over the last years are

shown below. What's the standard deviation of the firm's

returns? Hint: This is a sample, not a complete population,

so the sample standard deviation formula should be used.

Freedman Flowers' stock has a chance of producing a

return, a chance of producing a return, and a

chance of producing a return. What is the firm's

expected rate of return?

Zacher Cos stock has a beta of the riskfree rate is

and the market risk premium is What is the

firm's required rate of return?

You are offered two jobs. One initially pays $

annually, and your salary will grow annually at The

other pays $ annually, but your salary will grow at

After years, which job pays the higher salary?

An apartment will generate $ a year for years,

after which you expect to sell the property for $

What is the maximum you should pay for the property if

your cost of money is

The bigSox currently have spectators per game

and anticipate annual growth in attendance of If the

Big Stadium holds people, how long will it take for

the team reach capacity?

You bought an asset for $ and sold it for $

after years. What was the annual rate of return on this

investment?

Companies generate income from their "regular"

operations and from other sources like interest earned on

the securities they hold, which is called nonoperating

income. Lindley Textiles recently reported $ of

sales, $ of operating costs other than depreciation, and

$ of depreciation. The company had no amortization

charges and no nonoperating income. It had $ of

bonds outstanding that carry a interest rate, and its

federalplusstate income tax rate was How much was

Lindley's operating income, or EBIT?

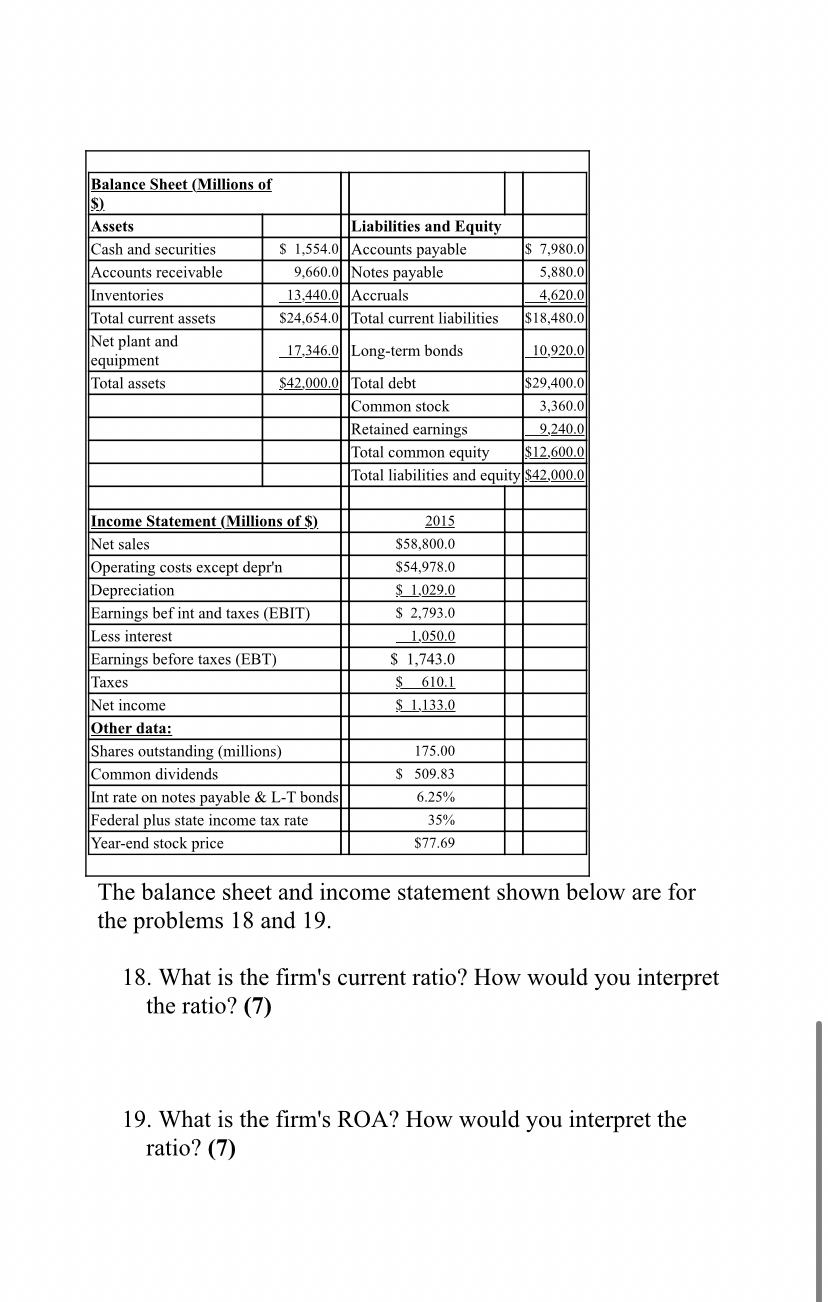

The balance sheet and income statement shown below are for

the problems and

What is the firm's current ratio? How would you interpret

the ratio?

What is the firm's ROA? How would you interpret the

ratio?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock