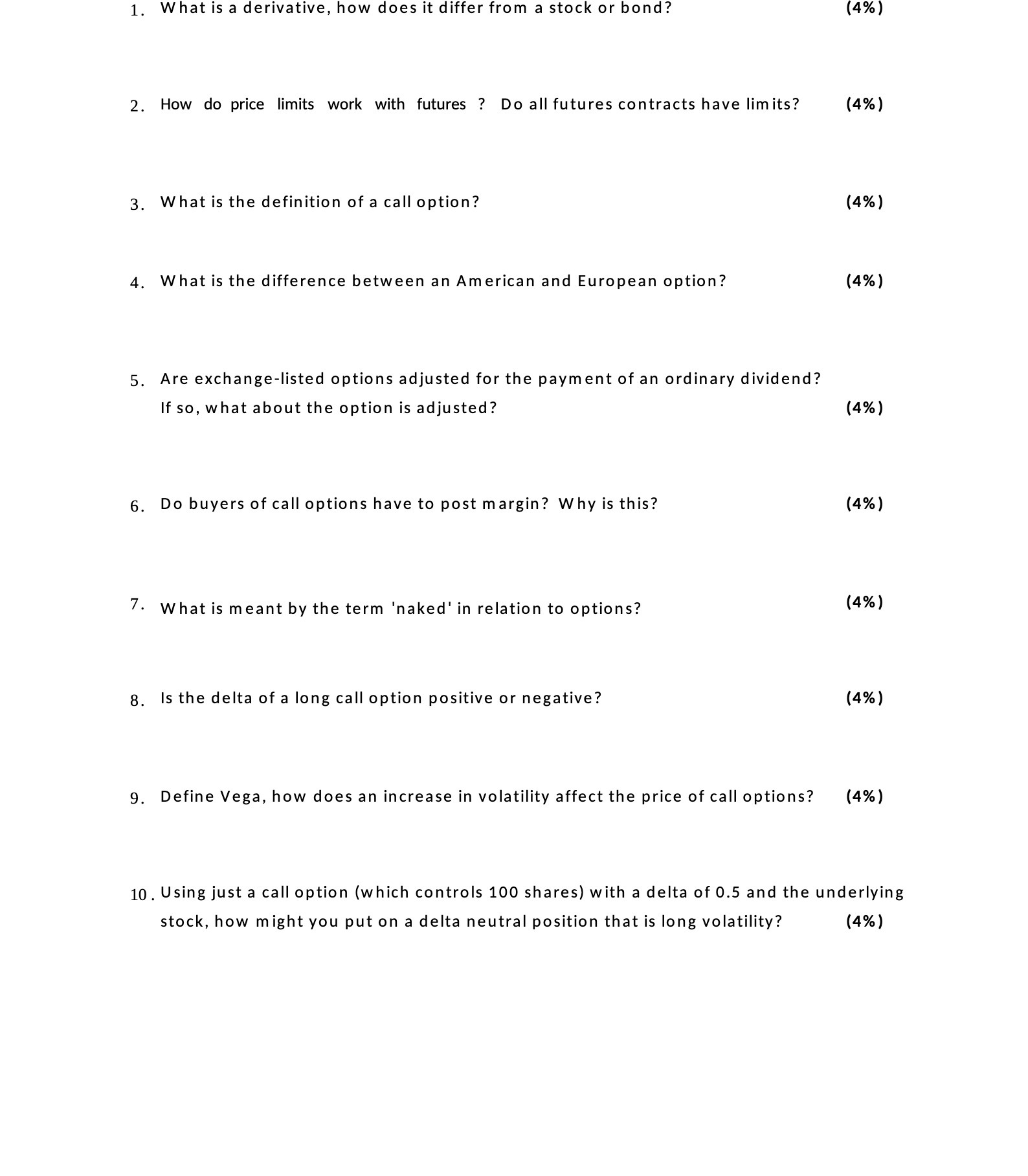

Question: 1. What is a derivative, how does it differ from a stock or bond? (4% ) 2. How do price limits work with futures ?

1. What is a derivative, how does it differ from a stock or bond? (4% ) 2. How do price limits work with futures ? Do all futures contracts have limits? (4%) 3. What is the definition of a call option? (4% ) . What is the difference between an American and European option? (4%) 5. Are exchange-listed options adjusted for the payment of an ordinary dividend? If so, what about the option is adjusted? (4%) 6. Do buyers of call options have to post margin? Why is this? (4% ) 7. What is meant by the term 'naked' in relation to options? (4%) 8. Is the delta of a long call option positive or negative? (4% ) 9. Define Vega, how does an increase in volatility affect the price of call options? (4%) 10. Using just a call option (which controls 100 shares) with a delta of 0.5 and the underlying stock, how might you put on a delta neutral position that is long volatility? (4% )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts