Question: 1 . What is a transfer price? 2 . Determine the possible transfer prices under the ( a ) Comparable Uncontrolled Price method, ( b

What is a transfer price?

Determine the possible transfer prices under the a Comparable Uncontrolled Price method, b Resale Price method, and c CostPlus method.

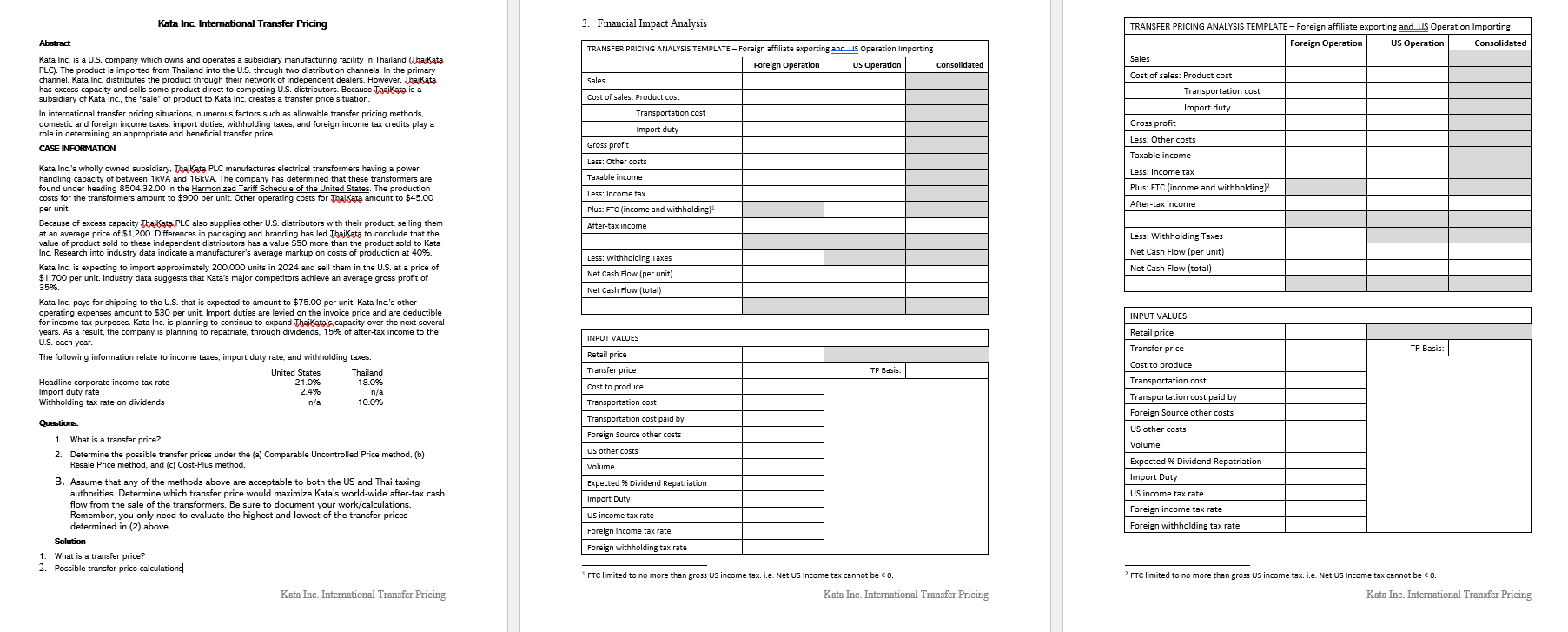

Assume that any of the methods above are acceptable to both the US and Thai taxing authorities. Determine which transfer price would maximize Katas worldwide aftertax cash flow from the sale of the transformers. Be sure to document your workcalculations Remember, you only need to evaluate the highest and lowest of the transfer prices determined in above. Financial Impact Analysis

FTC limited to no more than gross US income tax. ie Net US income tax cannot be

Kata Inc. International Transfer Pricing

FTC limited to no more than gross US income tax. ie Net US Income tax cannot be

Kata Inc. International Transfer Pricing Abstract

Kata Inc. is a US company which owns and operates a subsidiary manufacturing facility in Thailand Thajkata PLC The product is imported from Thailand into the US through two distribution channels. In the primary channel, Kata Inc. distributes the product through their network of independent dealers. However, Jhajkaty has excess capacity and sells some product direct to competing US distributors. Because JhajKata is a subsidiary of Kata Inc., the "sale" of product to Kata Inc. creates a transfer price situation.

In international transfer pricing situations, numerous factors such as allowable transfer pricing methods, domestic and foreign income taxes, import duties, withholding taxes, and foreign income tax credits play a role in determining an appropriate and beneficial transfer price.

CASE INFORMATION

Kata Inc's wholly owned subsidiary. ThajKata PLC manufactures electrical transformers having a power handling capacity of between kVA and kVA The company has determined that these transformers are found under heading in the Harmonized Tariff Schedule of the United States. The production costs for the transformers amount to $ per unit. Other operating costs for JhajKatg amount to $ per unit.

Because of excess capacity JhajKata,PLC also supplies other US distributors with their product, selling them at an average price of $ Differences in packaging and branding has led Thajkata to conclude that the value of product sold to these independent distributors has a value $ more than the product sold to Kata Inc. Research into industry data indicate a manufacturer's average markup on costs of production at

Kata Inc. is expecting to import approximately units in and sell them in the US at a price of $ per unit. Industry data suggests that Kata's major competitors achieve an average gross profit of

Kata Inc. pays for shipping to the US that is expected to amount to $ per unit. Kata Inc.s other operating expenses amount to $ per unit. Import duties are levied on the invoice price and are deductible for income tax purposes. Kata Inc. is planning to continue to expand JhajKata's, capacity over the next several years. As a result, the company is planning to repatriate, through dividends, of aftertax income to the US each year.

The following information relate to income taxes, import duty rate, and withholding taxes:

Questions:

What is a transfer price?

Determine the possible transfer prices under the a Comparable Uncontrolled Price method, b Resale Price method, and c CostPlus method.

Assume that any of the methods above are acceptable to both the US and Thai taxing authorities. Determine which transfer price would maximize Kata's worldwide aftertax cash flow from the sale of the transformers. Be sure to document your workcalculations Remember, you only need to evaluate the highest and lowest of the transfer prices determined in above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock