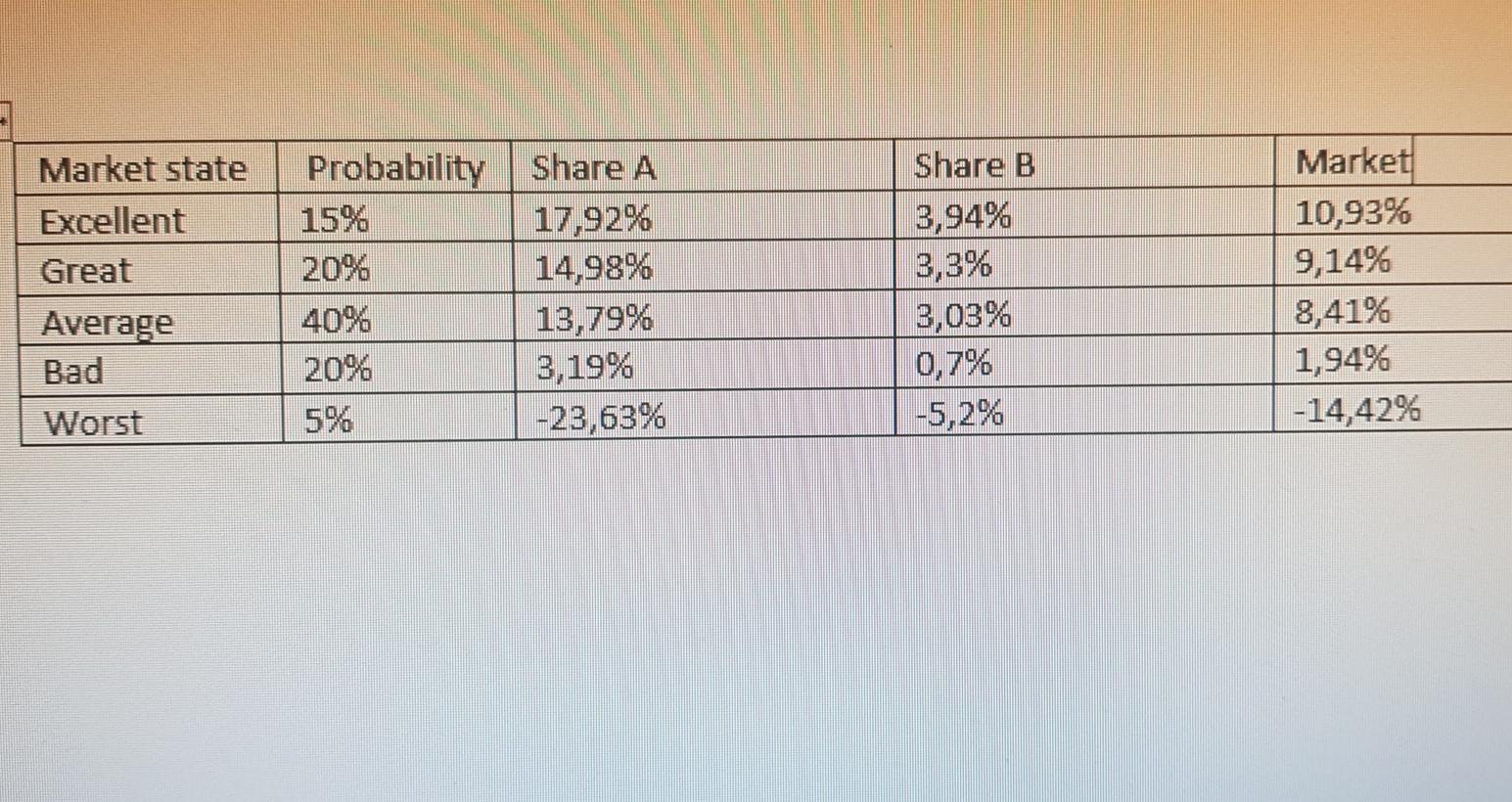

Question: 1) what is covariance between Share A and B 2)Assuming 60/40 weight between Share A & B what is the expected portfolio return? Market state

1) what is covariance between Share A and B 2)Assuming 60/40 weight between Share A & B what is the expected portfolio return?

Market state Excellent Great Average Bad Probability Share A 15% 17,92% 2096 14,98% 40% 13,79% 20% 3,19% 5% -23,63% Share B 3,94% 3,3% 3,03% 0,7% 1-5,2% Market 10,93% 9,14% 8,41% 1,94% -14,42% Worst

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock