Question: 1. What is materiality? In your response, please include the different aspects of materiality we have discussed. 2. Based on information contained in the cases

1. What is materiality? In your response, please include the different aspects of materiality we have discussed.

2. Based on information contained in the cases and an analysis of the balance sheet and income statement for The Bargain Club, suggest three potential bases and percentage ranges for each base that you believe should be considered to use in establishing planning materiality for The Bargain Club. For each, provide a rationale for why financial statement users might emphasize the suggested bases and why higher or lower percentages for each range might be selected.

3. Based on your analysis, conclude what you believe is the best approach in planning materiality for the 2019 audit engagement for the Bargain Club. Carefully document your recommendation using arguments that you believe would be most defensible to internal and external stakeholders (e.g., partners, internal quality review teams, external regulators like the PCAOB and SEC, judicial stakeholders like judges and juries, and the media). Please include the 2019 materiality level for your selected method.

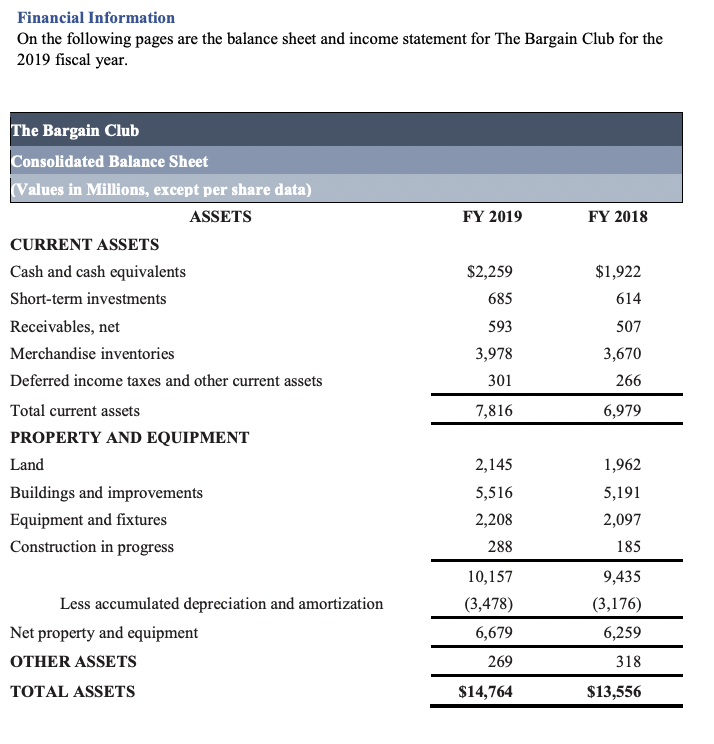

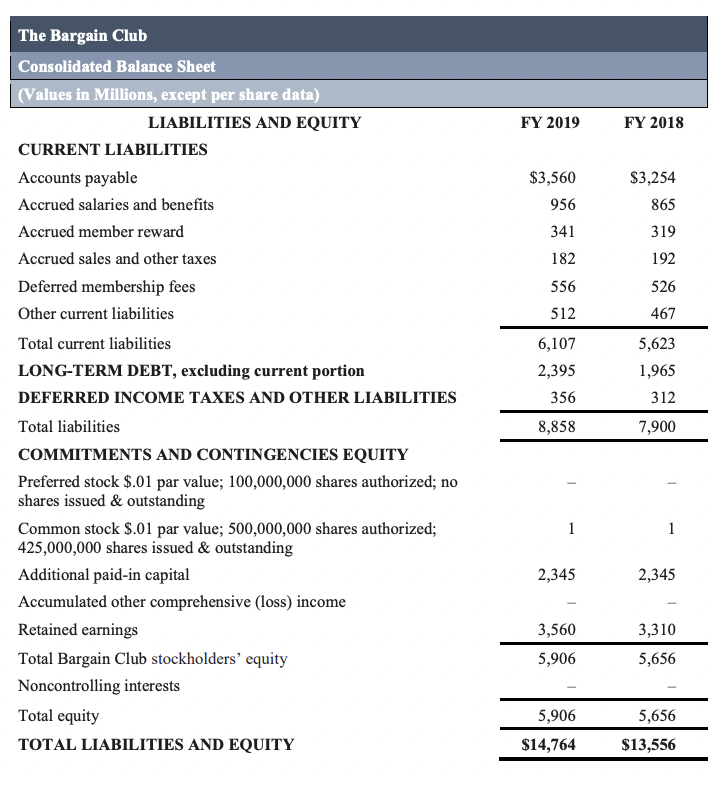

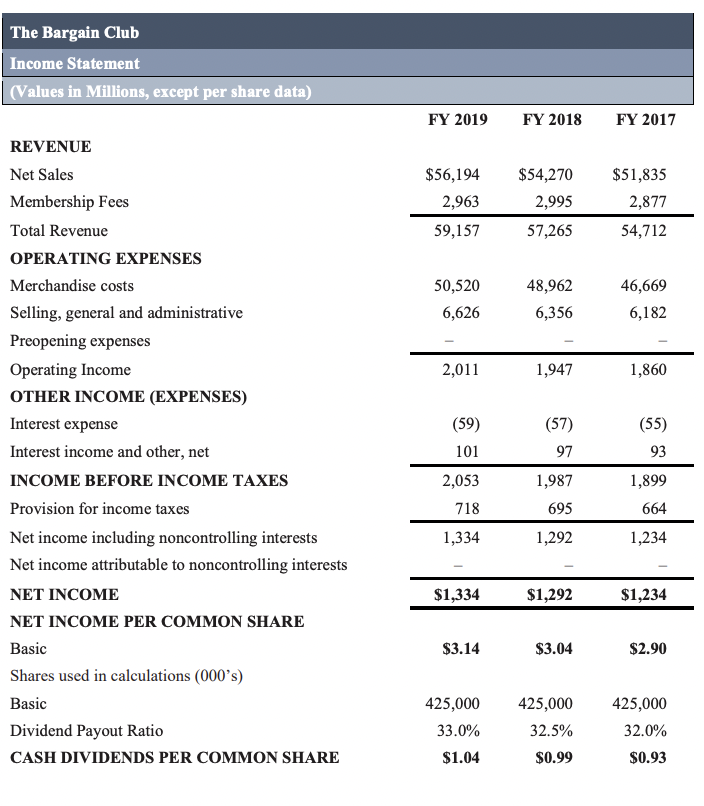

Financial Information On the following pages are the balance sheet and income statement for The Bargain Club for the 2019 fiscal year. The Bargain Club Consolidated Balance Sheet Values in Millions, except per share data) ASSETS FY 2019 FY 2018 CURRENT ASSETS Cash and cash equivalents $2,259 $1,922 Short-term investments 685 614 Receivables, net 593 507 Merchandise inventories 3,978 3,670 Deferred income taxes and other current assets 301 266 Total current assets 7,816 6,979 PROPERTY AND EQUIPMENT Land 2,145 1,962 Buildings and improvements 5,516 5,191 Equipment and fixtures 2,208 2,097 Construction in progress 288 185 10,157 9,435 Less accumulated depreciation and amortization 3,478) (3,176) Net property and equipment 6,679 6,259 OTHER ASSETS 269 318 TOTAL ASSETS $14,764 $13,556The Bargain Club Consolidated Balance Sheet (Values in Minion, except per share data) LIABILITIES AND EQUITY FY 2019 FY 2018 CURRENT LIABILITIES Accounts payable $3,560 $3,254 Accrued salaries and benets 956 865 Accrued member reward 341 3 19 Accrued sales and other taxes 182 192 Deferred membership fees 556 526 Other current liabilities 512 467 Total current liabilities 6,10? 5,623 LONG-TERM DEBT, excluding current portion 2,395 1,965 DEFERRED INCOME TAXES AND OTHER LIABILITIES 356 312 Total liabilities 3,858 7,900 COMMITMENTS AND CONTINGENCIES EQUITY Preferred stock $.01 par value; 100,000,000 shares authorized; no * shares issued & outstanding Common stock $.01 par value; 500,000,000 shares authorized; 1 1 425,000,000 shares issued & outstanding Additional paid-in capital 2,345 2,345 Accumulated other comprehensive {loss} income Retained earnings 3,560 3,310 Total Bargain Club stockholders' equity 5,906 5,656 Nonconlrolling interests Total equity 5,906 5,656 TOTAL LIABILITIES AND EQUITY $14,764 $13,556 The Bargain Club Income Statement (Values in Millions, exqut per share data] FY 2019 FY 2018 FY 2017 REVENUE Net Sales $56,194 $54,270 $51,835 Membership Fees 2,963 2,995 2,377 Total Revenue 59,157 57,265 54,112 OPERATING EXPENSES Merchandise costs 50,5 20 48,962 46,669 Selling, general and administrative 6,626 6,356 6,182 Preopening expenses ' Operating Income 2,011 1,94'irI 1,860 OTHER INCOME (EXPENSES) Interest expense (59} (57} (55} Interest income and other, net 101 9'7 93 INCOME BEFORE INCOME TAXES 2,053 1,98'}I 1,399 Provision for income taxes 718 695 664 Net income including noncontrolling interests 1,334 1,292 1,234 Net income attributable to noncontrolling interests A NET INCOME $1,334 $1,292 $1,234 NET INCOME PER COMMON SHARE Basic $3.14 $3.04 $2.90 Shares used in calculations (000's) Basic 425,000 425,000 425,000 Dividend Payout Ratio 310% 32. 5% 32.0% CASH DIVIDENDS PER COMMON SHARE $1.04 $0.99 $0.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts