Question: 1. what is missing on the chart? 2. operating expenses percentages 3. need help with the wrong answers 4. FIFO, LIFO, weighted average and gross

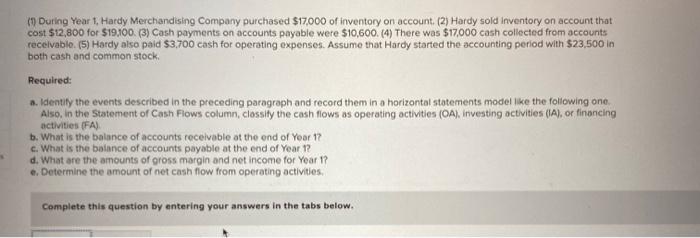

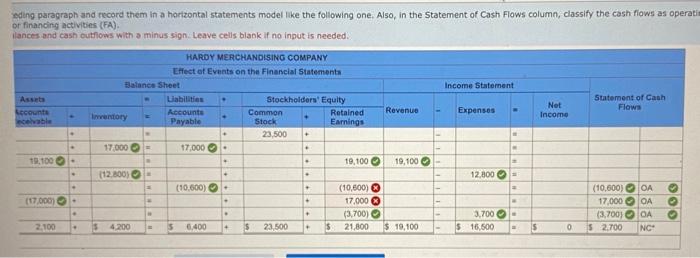

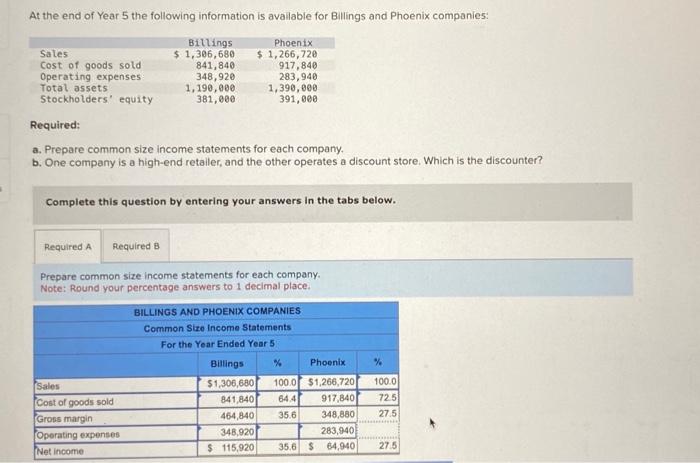

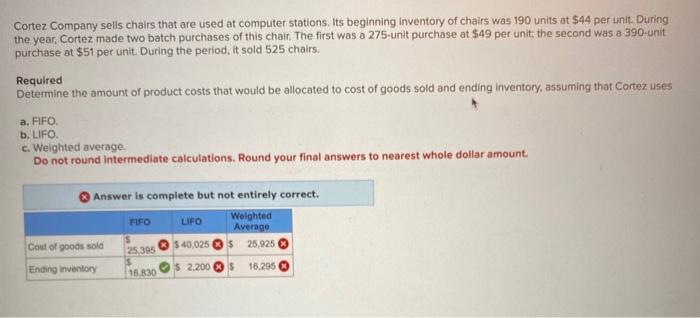

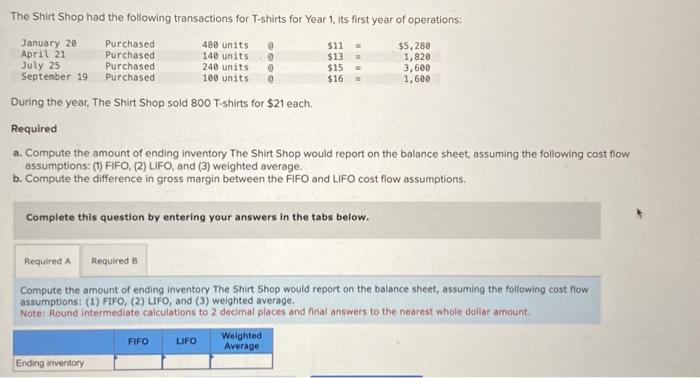

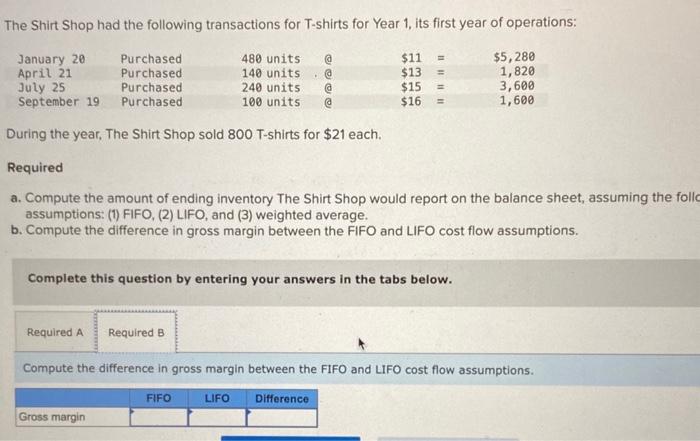

(1) During Year 1, Hardy Merchandising Company purchased $17,000 of inventory on account, (2) Hardy sold inventory on account that cost $12,800 for $19,100. (3) Cash payments on accounts payable were $10,600. (4) There was $17,000 cash collected from accounts receivablo. (5) Hardy also paid $3,700 cash for operating expenses. Assume that Hardy started the accounting period with $23,500 in both cash and common stock. Required: a. Identify the events described in the preceding paragraph and record them in a horizontal statements model like the following one. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA) b. What is the balance of accounts receivable ot the end of Year 17 c. What is the balance of accounts payable at the end of Year 1 ? d. What are the arnounts of gross margin and net income for Year 1 ? e. Determine the amount of net cash flow from operating activities. Complete this question by entering your answers in the tabs below. At the end of Year 5 the following information is avallable for Billings and Phoenix companies: Required: a. Prepare common size income statements for each company. b. One company is a high-end retailer, and the other operates a discount store. Which is the discounter? Complete this question by entering your answers in the tabs below. Prepare common size income statements for each company. Note: Round your percentage answers to 1 decimal place. Eding paragraph and record them in a horizontal statements model like the following one. Also, in the Statement of Cash Flows column, classify the cash fiows as operab or financing activities (FA). lances and cash outflows with a minus sign. Leave cells blank if no input is needed. The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: During the year, The Shirt Shop sold 800 T-shirts for $21 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the foll assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions. Complete this question by entering your answers in the tabs below. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions. The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: During the year, The Shirt Shop sold 800 T-shirts for $21 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions. Complete this question by entering your answers in the tabs below. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LFF, and (3) weighted average. Note: Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount. Cortez Company sells chairs that are used at computer stations, Its beginning inventory of chairs was 190 units at $44 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 275 -unit purchase at $49 per unit; the second was a 390 -unit purchase at $51 per unit. During the period, it sold 525 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses a. FIFO. b. LIFO. c. Weighted average. Do not round intermediate calculations. Round your final answers to nearest whole dollar amount. 8 Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts