Question: 1. What is quantity 3? 2. What is quantity 5? 3. What is the absolute value of quantity 2? 4. What is the absolute value

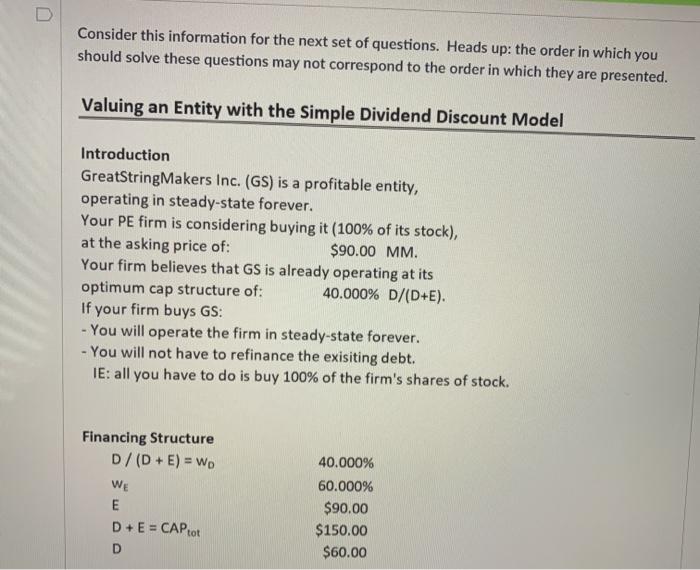

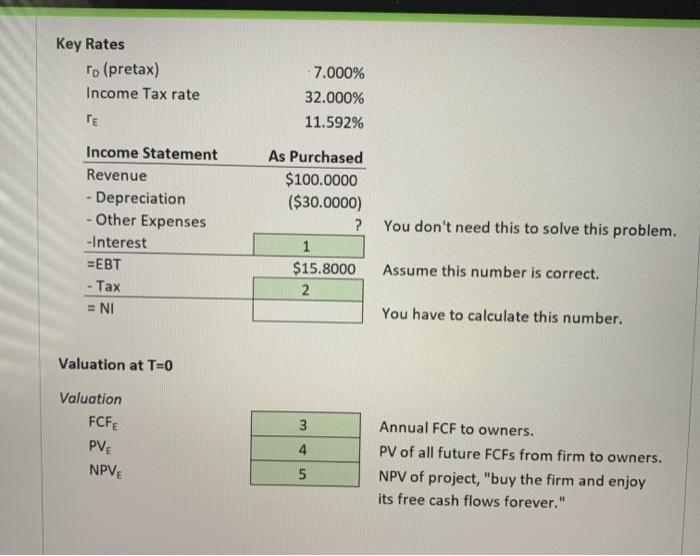

D Consider this information for the next set of questions. Heads up: the order in which you should solve these questions may not correspond to the order in which they are presented. Valuing an Entity with the Simple Dividend Discount Model Introduction GreatStringMakers Inc. (GS) is a profitable entity, operating in steady-state forever. Your PE firm is considering buying it (100% of its stock), at the asking price of: $90.00 MM. Your firm believes that GS is already operating at its optimum cap structure of: 40.000% D/(D+E). If your firm buys GS: - You will operate the firm in steady-state forever. - You will not have to refinance the exisiting debt. IE: all you have to do is buy 100% of the firm's shares of stock. Financing Structure D/(D+E) = W WE E D+ E = CAP Tot D 40.000% 60.000% $90.00 $150.00 $60.00 Key Rates ro (pretax) Income Tax rate 7.000% 32.000% 11.592% Income Statement Revenue - Depreciation - Other Expenses -Interest =EBT - Tax = NI As Purchased $100.0000 ($30.0000) ? You don't need this to solve this problem. $15.8000 2 Assume this number is correct. You have to calculate this number. Valuation at T=0 3 Valuation FCFE PVE NPVE 4 Annual FCF to owners. PV of all future FCFs from firm to owners. NPV of project, "buy the firm and enjoy its free cash flows forever." 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts