Question: 1. What is the companys basic earnings per share (EPS)? Did EPS vary more than 10% when compared to the prior year? Refer to the

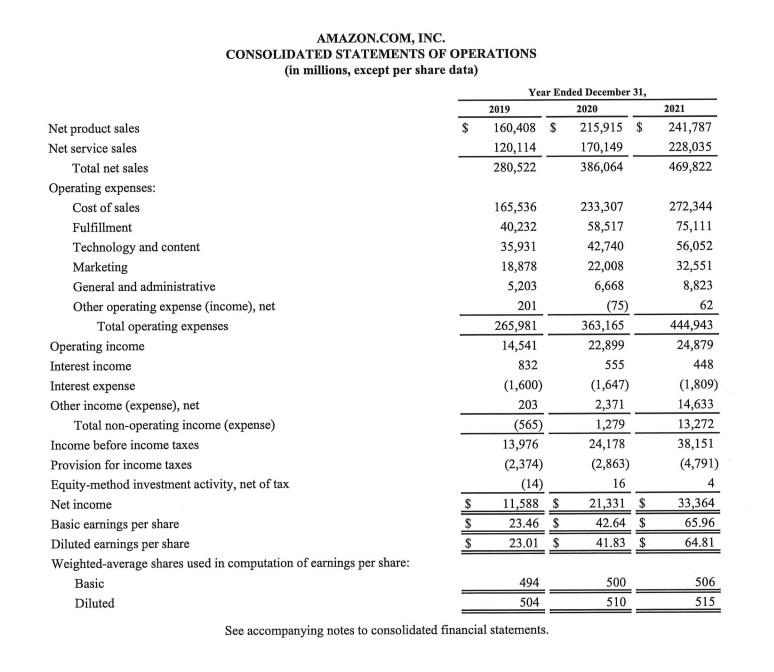

1. What is the companys basic earnings per share (EPS)? Did EPS vary more than 10% when compared to the prior year? Refer to the textbook for the calculation of Earnings per share. Hint: sometimes the EPS is calculated and included on the companys income statement.

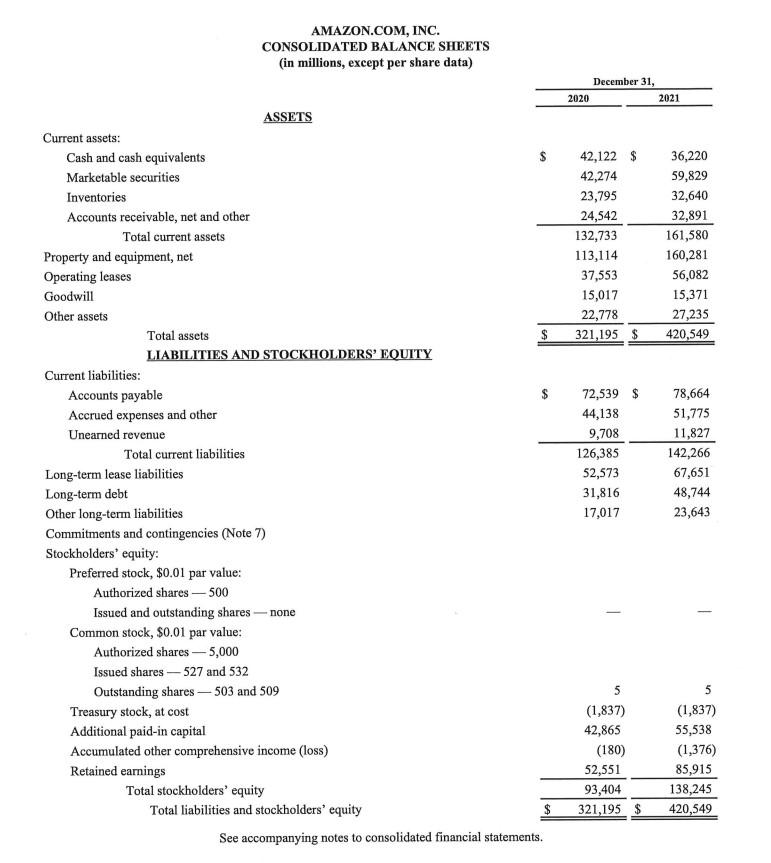

2. Calculate the following liquidity ratios for the current year. Explain the meaning of the calculation, and support a conclusion on whether the resulting ratio reflects a favorable or unfavorable situation for the company. Assume 50% of the company sales are on credit. . a. Current Ratio b. Accounts Receivables Turnover Ratio c. Inventory Turnover

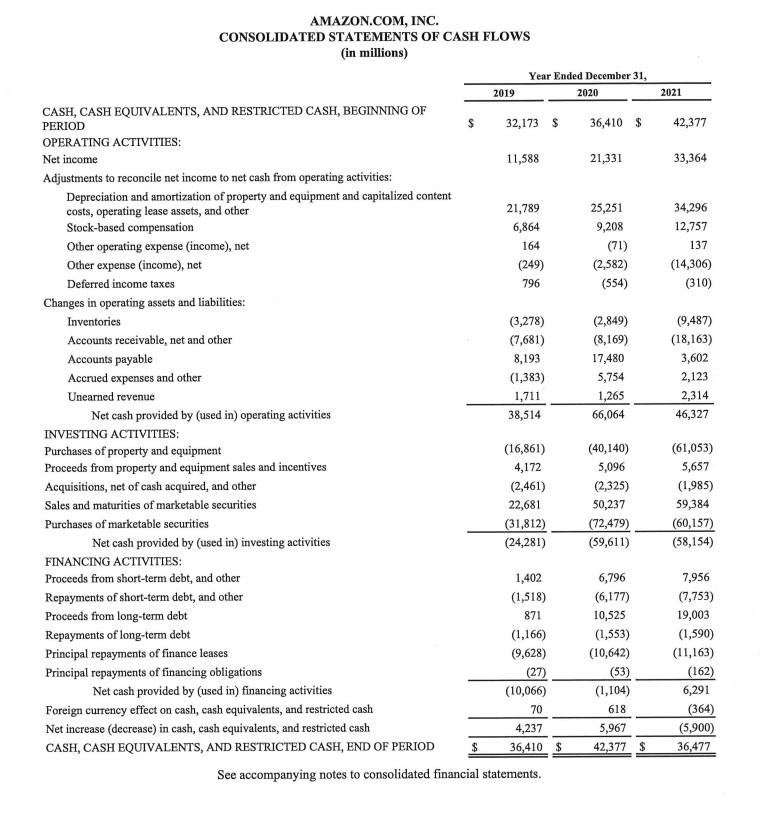

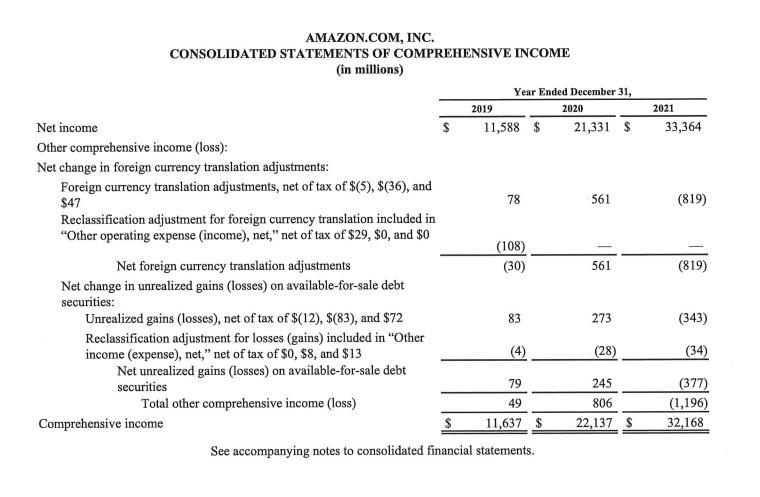

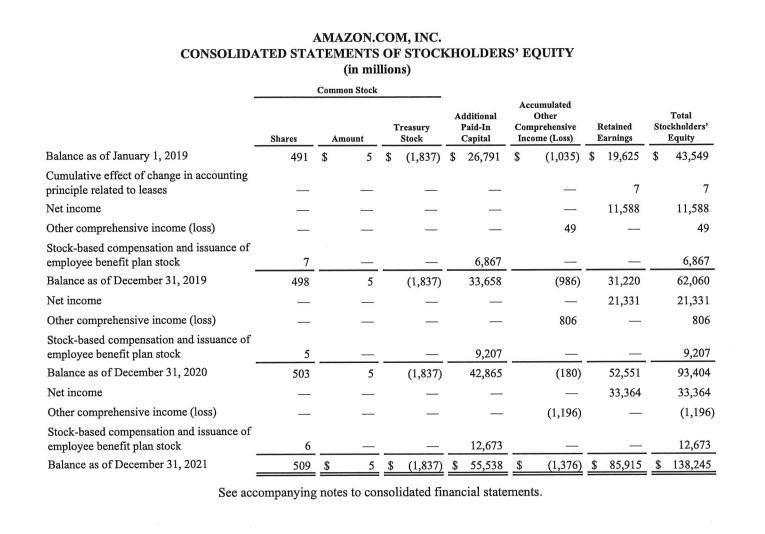

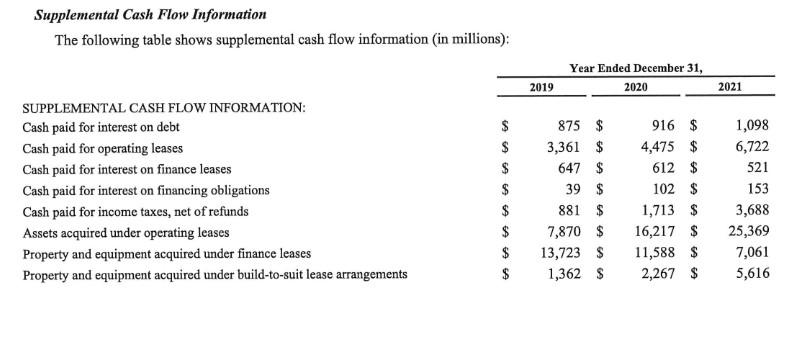

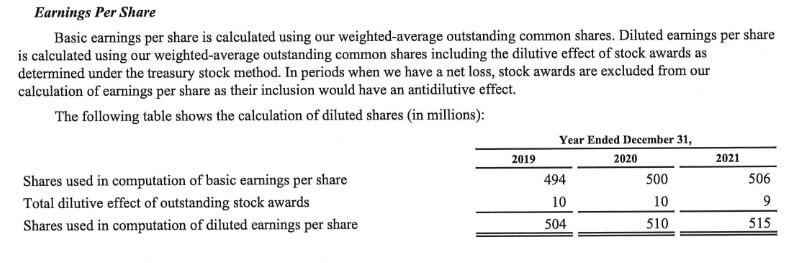

AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) see accompanymg nutes to consundated maticiat statcumens. AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY rtas west11tonon Dee accompanymg notes to consumuated nmancian statenicuts. Supplemental Cash Flow Information The following table shows supplemental cash flow information (in millions): Earnings Per Share Basic earnings per share is calculated using our weighted-average outstanding common shares. Diluted earnings per share is calculated using our weighted-average outstanding common shares including the dilutive effect of stock awards as determined under the treasury stock method. In periods when we have a net loss, stock awards are excluded from our calculation of earnings per share as their inclusion would have an antidilutive effect. The following table shows the calculation of diluted shares (in millions): Shares used in computation of basic earnings per share Total dilutive effect of outstanding stock awards Shares used in computation of diluted earnings per share AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (in millions) see accompanymg nutes to consundated maticiat statcumens. AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY rtas west11tonon Dee accompanymg notes to consumuated nmancian statenicuts. Supplemental Cash Flow Information The following table shows supplemental cash flow information (in millions): Earnings Per Share Basic earnings per share is calculated using our weighted-average outstanding common shares. Diluted earnings per share is calculated using our weighted-average outstanding common shares including the dilutive effect of stock awards as determined under the treasury stock method. In periods when we have a net loss, stock awards are excluded from our calculation of earnings per share as their inclusion would have an antidilutive effect. The following table shows the calculation of diluted shares (in millions): Shares used in computation of basic earnings per share Total dilutive effect of outstanding stock awards Shares used in computation of diluted earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts