Question: 1. What is the difference between a contingent liability and an estimated liability? How are contingent liabilities handled in a company's financial statements? 2. Why

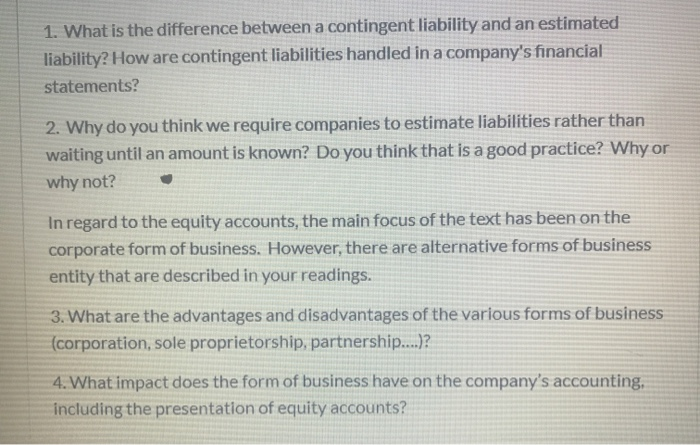

1. What is the difference between a contingent liability and an estimated liability? How are contingent liabilities handled in a company's financial statements? 2. Why do you think we require companies to estimate liabilities rather than waiting until an amount is known? Do you think that is a good practice? Why or why not? In regard to the equity accounts, the main focus of the text has been on the corporate form of business. However, there are alternative forms of business entity that are described in your readings. 3. What are the advantages and disadvantages of the various forms of business (corporation, sole proprietorship, partnership....)? 4. What impact does the form of business have on the company's accounting, including the presentation of equity accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts