Question: 1. What is the difference between a long forward position and a short forward position? 2. Explain carefully the difference between selling a call option

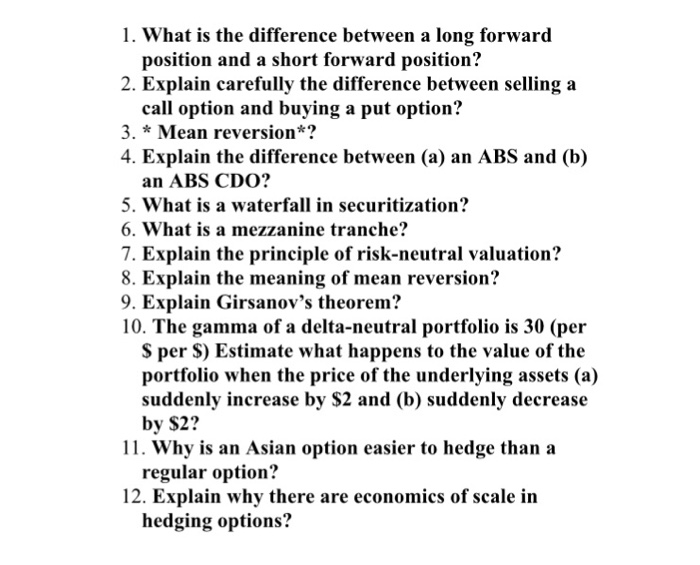

1. What is the difference between a long forward position and a short forward position? 2. Explain carefully the difference between selling a call option and buying a put option? 3. * Mean reversion*? 4. Explain the difference between (a) an ABS and (b) an ABS CDO? 5. What is a waterfall in securitization? 6. What is a mezzanine tranche? 7. Explain the principle of risk-neutral valuation? 8. Explain the meaning of mean reversion:? 9. Explain Girsanov's theorem? 10. The gamma of a delta-neutral portfolio is 30 (per S per S) Estimate what happens to the value of the portfolio when the price of the underlying assets (a) suddenly increase by S2 and (b) suddenly decrease by S2? 11. Why is an Asian option easier to hedge than a regular option? 12. Explain why there are economics of scale in hedging options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts