Question: 1. What is the difference between a secured loan and an unsecured loan? Define each term, and provide two examples of each type of loan.

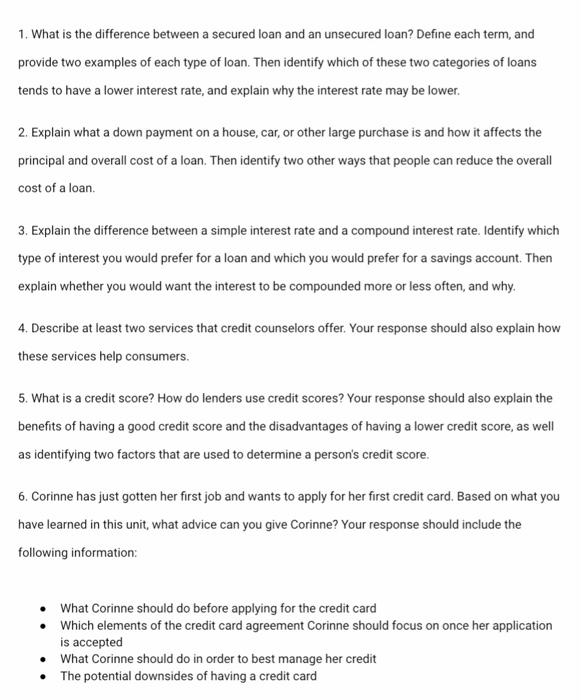

1. What is the difference between a secured loan and an unsecured loan? Define each term, and provide two examples of each type of loan. Then identify which of these two categories of loans tends to have a lower interest rate, and explain why the interest rate may be lower. 2. Explain what a down payment on a house, car, or other large purchase is and how it affects the principal and overall cost of a loan. Then identify two other ways that people can reduce the overall cost of a loan. 3. Explain the difference between a simple interest rate and a compound interest rate. Identify which type of interest you would prefer for a loan and which you would prefer for a savings account. Then explain whether you would want the interest to be compounded more or less often, and why. 4. Describe at least two services that credit counselors offer. Your response should also explain how these services help consumers. 5. What is a credit score? How do lenders use credit scores? Your response should also explain the benefits of having a good credit score and the disadvantages of having a lower credit score, as well as identifying two factors that are used to determine a person's credit score. 6. Corinne has just gotten her first job and wants to apply for her first credit card. Based on what you have learned in this unit, what advice can you give Corinne? Your response should include the following information: What Corinne should do before applying for the credit card Which elements of the credit card agreement Corinne should focus on once her application is accepted What Corinne should do in order to best manage her credit The potential downsides of having a credit card

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts