Question: 1. What is the difference between asset allocation and security selection? 2. What does it mean to sell a security short? Why might you do

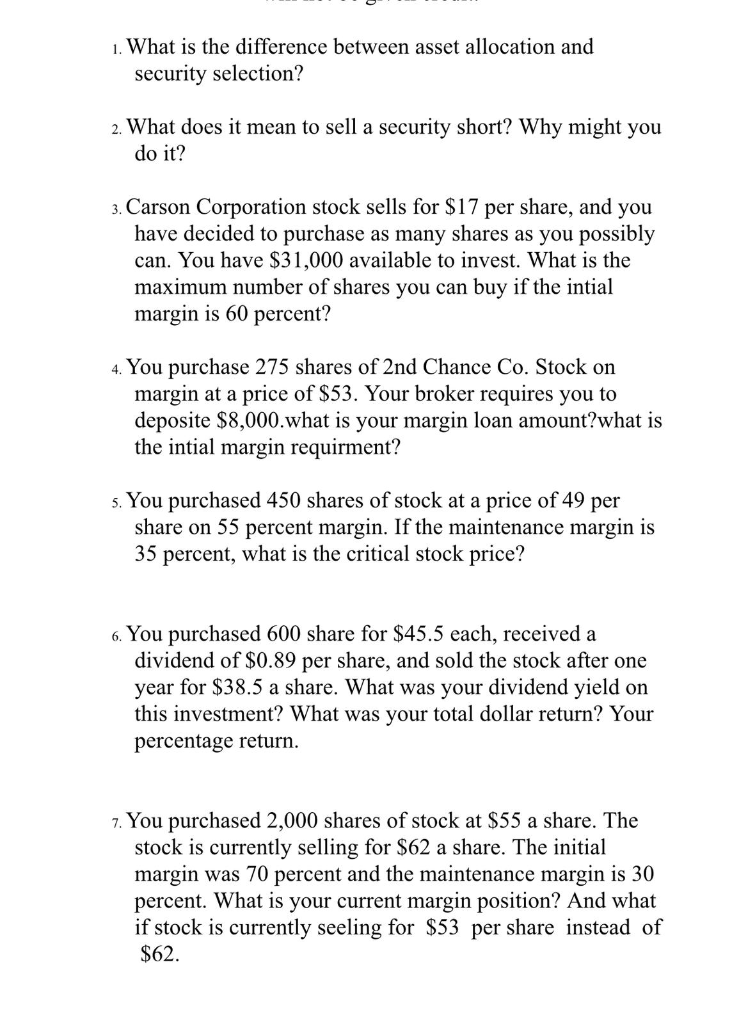

1. What is the difference between asset allocation and security selection? 2. What does it mean to sell a security short? Why might you do it? 3. Carson Corporation stock sells for $17 per share, and you have decided to purchase as many shares as you possibly can. You have $31,000 available to invest. What is the maximum number of shares you can buy if the intial margin is 60 percent? 4. You purchase 275 shares of 2nd Chance Co. Stock on margin at a price of $53. Your broker requires you to deposite $8,000.what is your margin loan amount?what is the intial margin requirment? 5. You purchased 450 shares of stock at a price of 49 per share on 55 percent margin. If the maintenance margin is 35 percent, what is the critical stock price? 6. You purchased 600 share for $45.5 each, received a dividend of $0.89 per share, and sold the stock after one year for $38.5 a share. What was your dividend yield on this investment? What was your total dollar return? Your percentage return. 7. You purchased 2,000 shares of stock at $55 a share. The stock is currently selling for $62 a share. The initial margin was 70 percent and the maintenance margin is 30 percent. What is your current margin position? And what if stock is currently seeling for $53 per share instead of $62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts