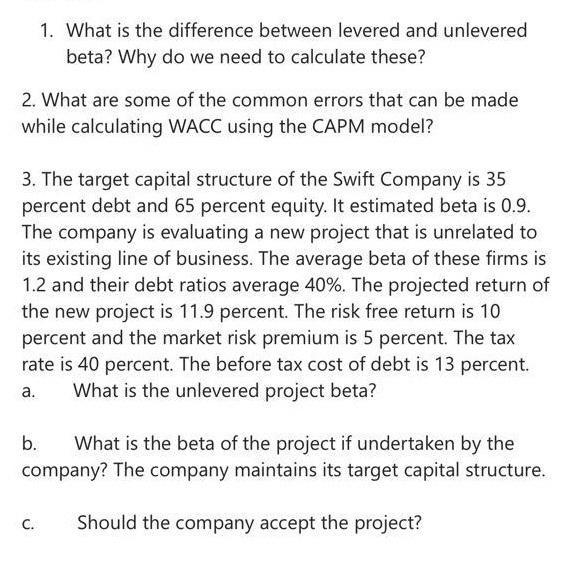

Question: 1. What is the difference between levered and unlevered beta? Why do we need to calculate these? 2. What are some of the common errors

1. What is the difference between levered and unlevered beta? Why do we need to calculate these? 2. What are some of the common errors that can be made while calculating WACC using the CAPM model? 3. The target capital structure of the Swift Company is 35 percent debt and 65 percent equity. It estimated beta is 0.9. The company is evaluating a new project that is unrelated to its existing line of business. The average beta of these firms is 1.2 and their debt ratios average 40%. The projected return of the new project is 11.9 percent. The risk free return is 10 percent and the market risk premium is 5 percent. The tax rate is 40 percent. The before tax cost of debt is 13 percent. What is the unlevered project beta? a. b. What is the beta of the project if undertaken by the company? The company maintains its target capital structure. C. Should the company accept the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts