Question: 1. What is the expected return on a stock with a beta of 1.2 , given a risk-free rate of 1.5% and an expected market

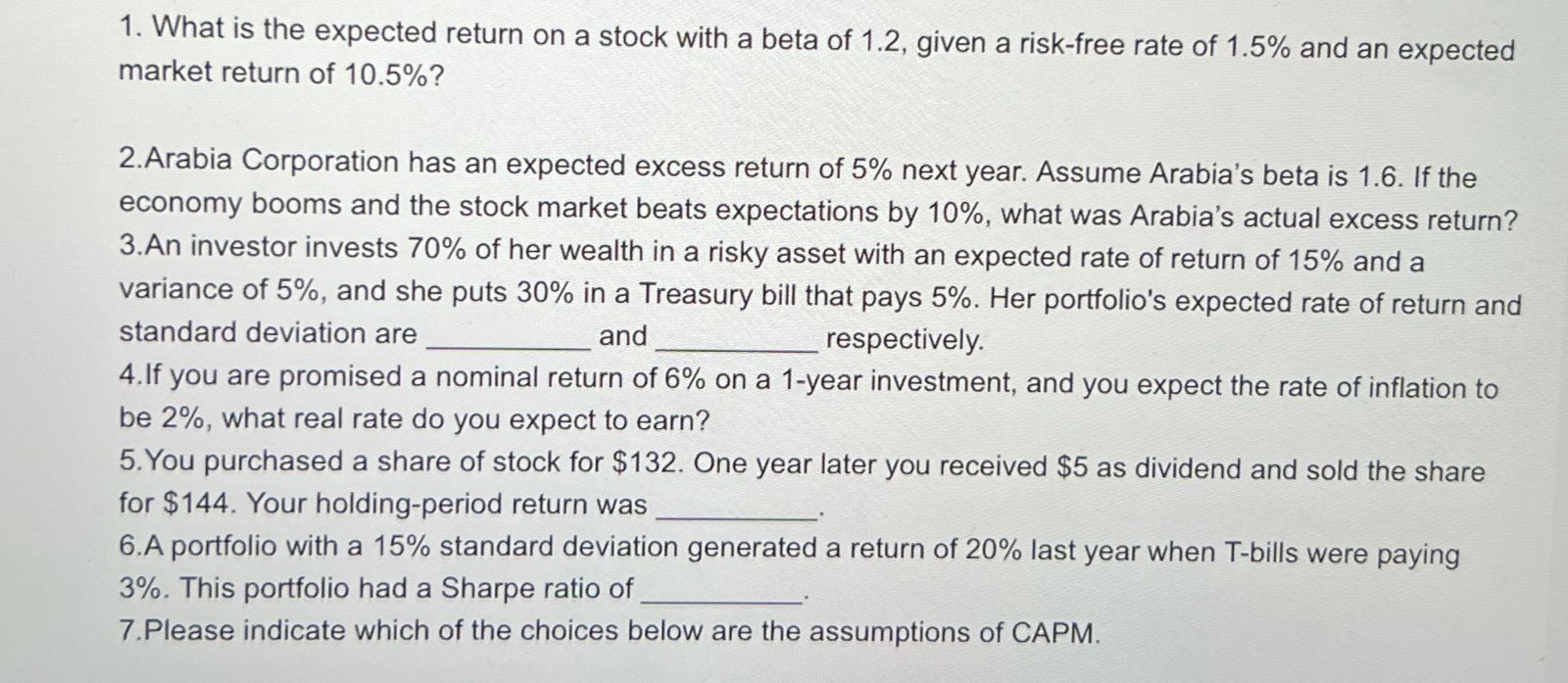

1. What is the expected return on a stock with a beta of 1.2 , given a risk-free rate of 1.5% and an expected market return of 10.5% ? 2.Arabia Corporation has an expected excess return of 5% next year. Assume Arabia's beta is 1.6 . If the economy booms and the stock market beats expectations by 10%, what was Arabia's actual excess return? 3.An investor invests 70% of her wealth in a risky asset with an expected rate of return of 15% and a variance of 5%, and she puts 30% in a Treasury bill that pays 5%. Her portfolio's expected rate of return and standard deviation are and respectively. 4. If you are promised a nominal return of 6% on a 1 -year investment, and you expect the rate of inflation to be 2%, what real rate do you expect to earn? 5. You purchased a share of stock for $132. One year later you received $5 as dividend and sold the share for $144. Your holding-period return was 6.A portfolio with a 15% standard deviation generated a return of 20% last year when T-bills were paying 3%. This portfolio had a Sharpe ratio of 7.Please indicate which of the choices below are the assumptions of CAPM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts