Question: 1- What is the loan principle based on the two underwriting criteria? 2- What is the actual loan to value ratio for this loan? In

1- What is the loan principle based on the two underwriting criteria?

2- What is the actual loan to value ratio for this loan?

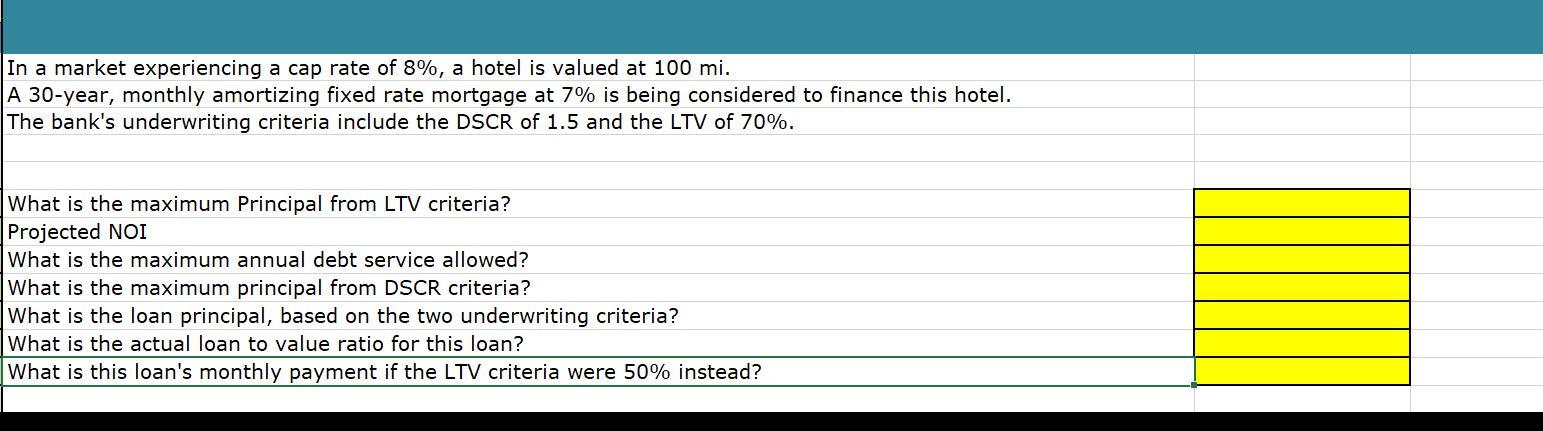

In a market experiencing a cap rate of 8%, a hotel is valued at 100 mi. A 30-year, monthly amortizing fixed rate mortgage at 7% is being considered to finance this hotel. The bank's underwriting criteria include the DSCR of 1.5 and the LTV of 70%. What is the maximum Principal from LTV criteria? Projected NOI What is the maximum annual debt service allowed? What is the maximum principal from DSCR criteria? What is the loan principal, based on the two underwriting criteria? What is the actual loan to value ratio for this loan? What is this loan's monthly payment if the LTV criteria were 50% instead? In a market experiencing a cap rate of 8%, a hotel is valued at 100 mi. A 30-year, monthly amortizing fixed rate mortgage at 7% is being considered to finance this hotel. The bank's underwriting criteria include the DSCR of 1.5 and the LTV of 70%. What is the maximum Principal from LTV criteria? Projected NOI What is the maximum annual debt service allowed? What is the maximum principal from DSCR criteria? What is the loan principal, based on the two underwriting criteria? What is the actual loan to value ratio for this loan? What is this loan's monthly payment if the LTV criteria were 50% instead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts