Question: 1. What is the main difference between the M1 and M2 definitions of the money supply? Find them from the web. 2. What policy tools

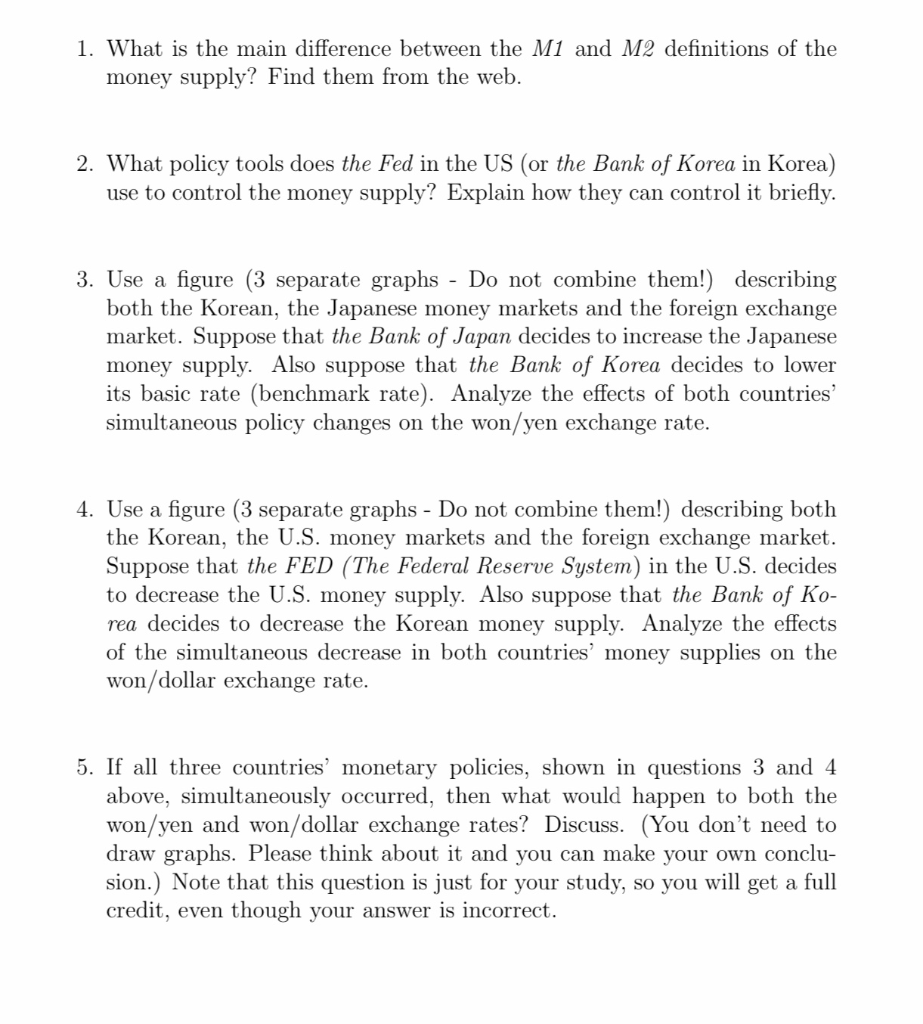

1. What is the main difference between the M1 and M2 definitions of the money supply? Find them from the web. 2. What policy tools does the Fed in the US (or the Bank of Korea in Korea) use to control the money supply? Explain how they can control it briefly. 3. Use a figure (3 separate graphs - Do not combine them!) describing both the Korean, the Japanese money markets and the foreign exchange market. Suppose that the Bank of Japan decides to increase the Japanese money supply. Also suppose that the Bank of Korea decides to lower its basic rate (benchmark rate). Analyze the effects of both countries' simultaneous policy changes on the won/yen exchange rate. 4. Use a figure (3 separate graphs - Do not combine them!) describing both the Korean, the U.S. money markets and the foreign exchange market. Suppose that the FED (The Federal Reserve System) in the U.S. decides to decrease the U.S. money supply. Also suppose that the Bank of Ko- rea decides to decrease the Korean money supply. Analyze the effects of the simultaneous decrease in both countries' money supplies on the won/dollar exchange rate. 5. If all three countries' monetary policies, shown in questions 3 and 4 above, simultaneously occurred, then what would happen to both the won/yen and won/dollar exchange rates? Discuss. (You don't need to draw graphs. Please think about it and you can make your own conclu- sion.) Note that this question is just for your study, so you will get a full credit, even though your answer is incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts