Question: 1) What is the major variance between the two quarters in relation to cash paid for? 2) Is the expected income going to be appropriate

1) What is the major variance between the two quarters in relation to cash paid for?

2) Is the expected income going to be appropriate in a forecasted period of 12 months based on the trends of your cash flow statement? Please explain your answer.

3) IF the forecasted income is not deemed high enough by Senior Executive what areas will the organisation need to focus on to increase the income/cash received?

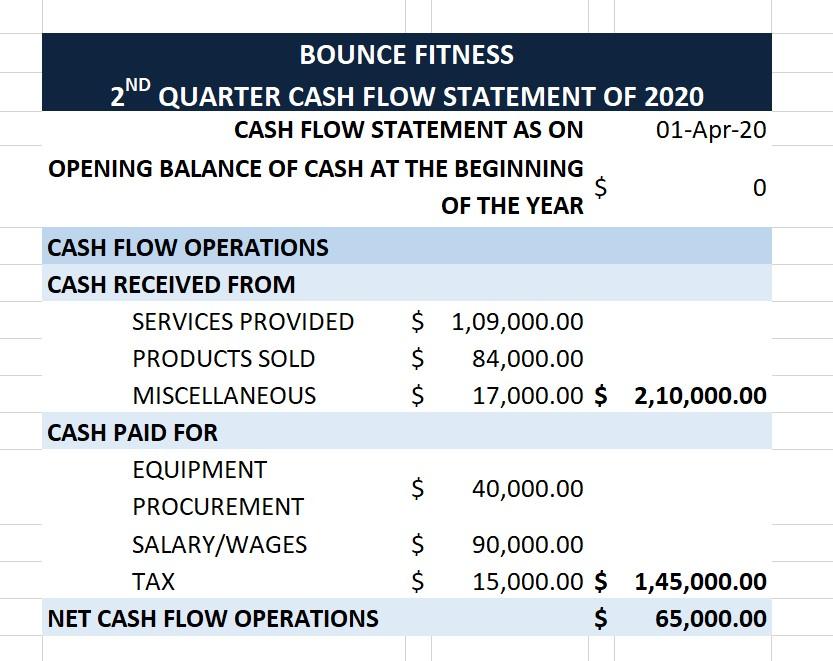

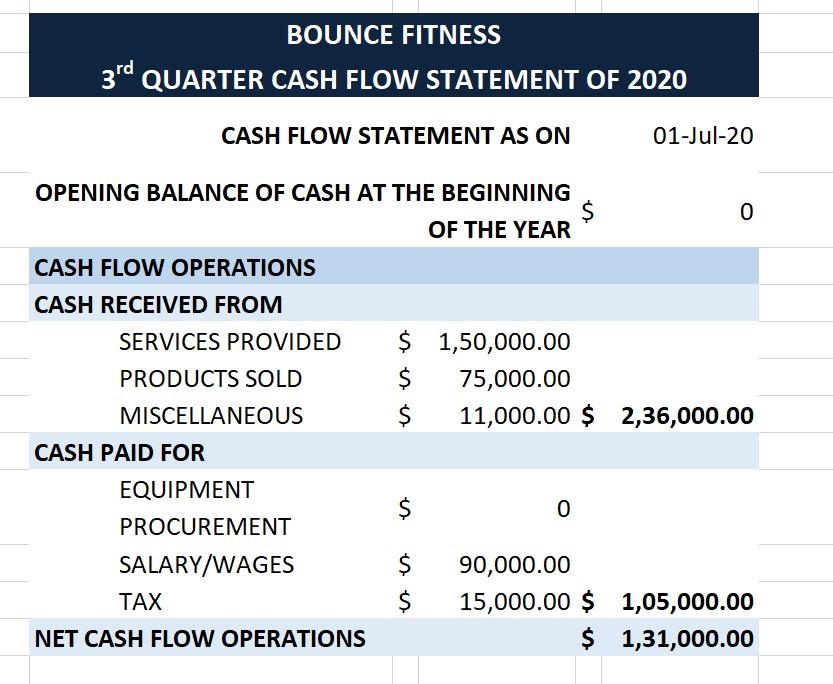

BOUNCE FITNESS 2ND QUARTER CASH FLOW STATEMENT OF 2020 CASH FLOW STATEMENT AS ON 01-Apr-20 OPENING BALANCE OF CASH AT THE BEGINNING $ 0 OF THE YEAR $ 1,09,000.00 $ 84,000.00 $ 17,000.00 $ 2,10,000.00 CASH FLOW OPERATIONS CASH RECEIVED FROM SERVICES PROVIDED PRODUCTS SOLD MISCELLANEOUS CASH PAID FOR EQUIPMENT PROCUREMENT SALARY/WAGES TAX NET CASH FLOW OPERATIONS $ $ 40,000.00 $ $ 90,000.00 15,000.00 $ 1,45,000.00 $ 65,000.00 $ BOUNCE FITNESS 3rd QUARTER CASH FLOW STATEMENT OF 2020 CASH FLOW STATEMENT AS ON 01-Jul-20 OPENING BALANCE OF CASH AT THE BEGINNING $ OF THE YEAR 0 CASH FLOW OPERATIONS CASH RECEIVED FROM SERVICES PROVIDED PRODUCTS SOLD MISCELLANEOUS CASH PAID FOR $ 1,50,000.00 $ 75,000.00 $ 11,000.00 $ 2,36,000.00 EQUIPMENT $ 0 $ PROCUREMENT SALARY/WAGES TAX NET CASH FLOW OPERATIONS $ 90,000.00 15,000.00 $ 1,05,000.00 $ 1,31,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts