Question: 1) What is the operating cash flow for this project in year 1? 2) What is the operating cash flow for this project in year

1) What is the operating cash flow for this project in year 1?

2) What is the operating cash flow for this project in year 2?

3) What is the operating cash flow for this project in year 3?

4) What is the operating cash flow for this project in year 4?

5) What is the operating cash flow for this project in year 5?

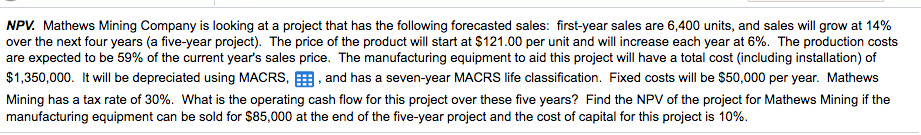

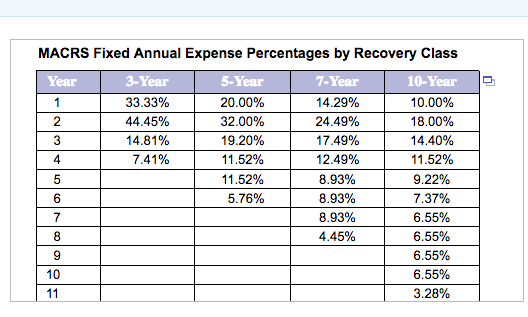

NPV Mathews Mining Company is looking at a project that has the following forecasted sales: first-year sales are 6,400 units, and sales will grow at 14% over the next four years a five-year project . The price of the product will start at $121.00 per unit and will increase each year at 6%. The production costs are expected to be 59% of the current year's sales price. The manufacturing equipment to aid this project wa have a total cost including instaa on of $1,350,000. It will be depreciated using MACRS,, and has a seven-year MACRS life classification. Fixed costs will be $50,000 per year. Mathews Mining has a tax rate of 30%. What is the operating cash flow for this project over these five years? Find the PVof the pro ect for Mathews Mining the manufacturing equipment can be sold for $85,000 at the end of the five-year project and the cost of capital for this project is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts