Question: 1) What is the optimal solution? 2) Which constraints are binding? Which constraints have slack/surplus? 3) Which parameter could be adjusted to make for a

1) What is the optimal solution?

2) Which constraints are binding? Which constraints have slack/surplus?

3) Which parameter could be adjusted to make for a better optimal solution.

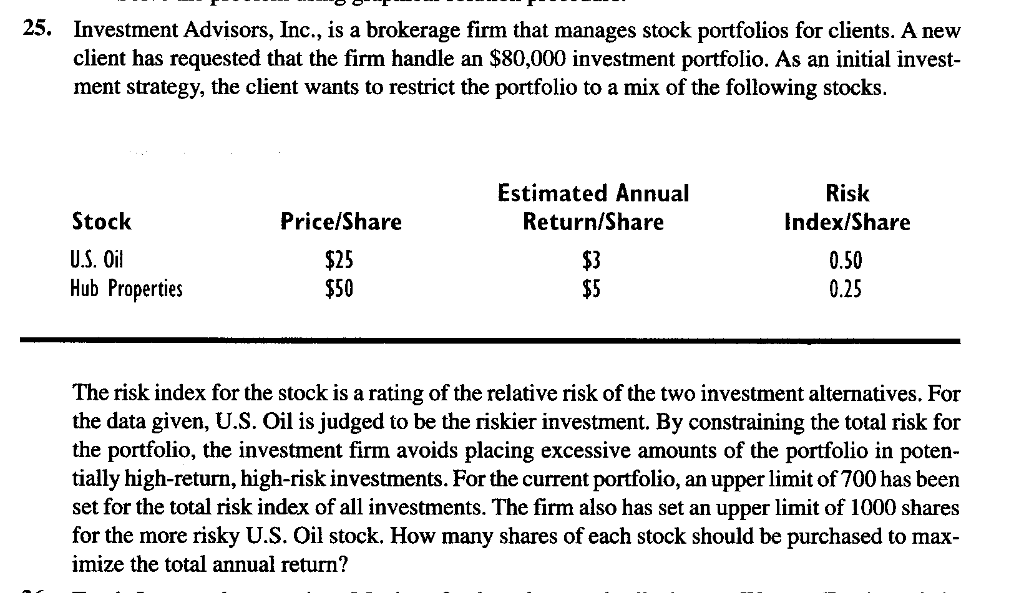

25. Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for clients. A new client has requested that the firm handle an $80,000 investment portfolio. As an initial invest- ment strategy, the client wants to restrict the portfolio to a mix of the following stocks. Risk Estimated Annual Index/Share Price/Share Stock Return/Share U.S. Oil $25 0.50 Hub Properties $50 0.25 The risk index for the stock is a rating of the relative risk of the two investment alternatives. For the data given, U.S. Oil is judged to be the riskier investment. By constraining the total risk for the portfolio, the investment firm avoids placing excessive amounts of the portfolio in poten- tially high-return, high-risk investments. For the current portfolio, an upper limit of 700 has been set for the total risk index of all investments. The firm also has set an upper limit of 1000 shares for the more risky U.S. Oil stock. How many shares of each stock should be purchased to max imize the total annual return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts