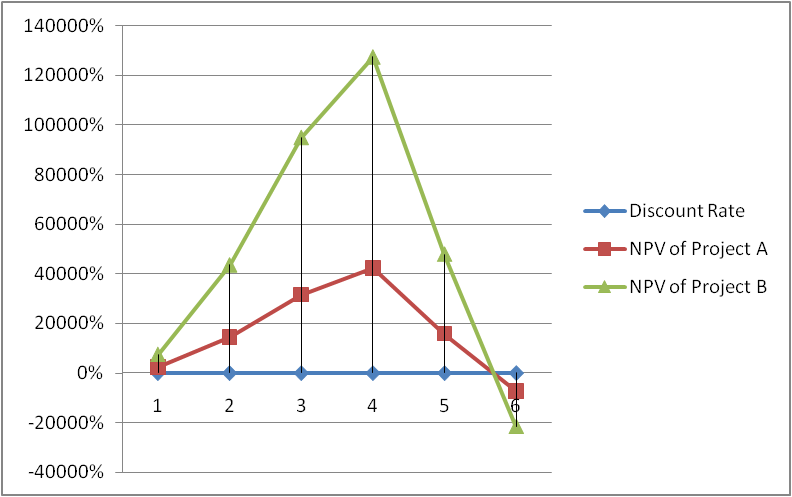

Question: 1. What is the problem with using the Internal Rate of Return capital budgeting method when deciding between two mutually exclusive projects? Discuss and illustrate

1. What is the problem with using the Internal Rate of Return capital budgeting method when deciding between two mutually exclusive projects? Discuss and illustrate your explanation with a graph. [10 marks]

2. Discuss the life cycle model of savings and the related inter-temporal budget constraint formula. [10 marks]

3. In the context of corporate governance, discuss and contrast three types of legal forms for firms. [10 marks]

4. Discuss the five principles at the core of the financial system of market economies. [10 marks]

5. What is the Net Working Capital? How and why is it included in the cash flows of the firm? Explain. [10 marks]

\f

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts