Question: 1) What is the required return for MMM( (e.g., 5.6% ); 2) What is the selling price in two years (e.g., $54.57)? 3) What is

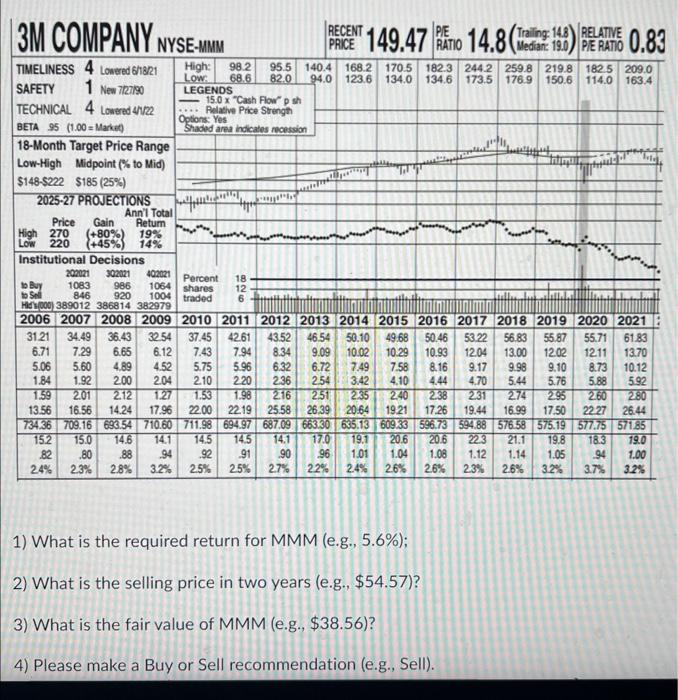

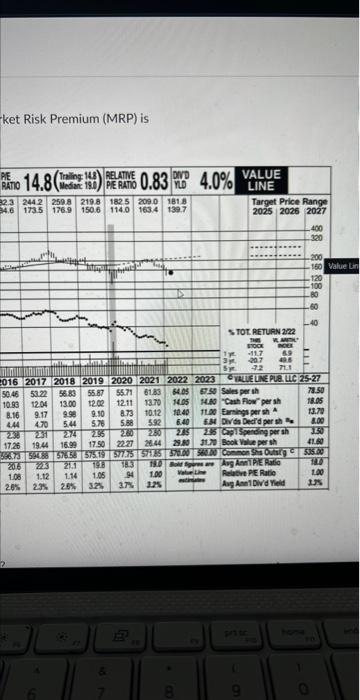

1) What is the required return for MMM( (e.g., 5.6% ); 2) What is the selling price in two years (e.g., \$54.57)? 3) What is the fair value of MMM(e.g.,$38.56) ? 4) Please make a Buy or Sell recommendation (e.g., Sell). Pretend that today is January 1 st 2022 and that the fiscal year end for the company is December 31st 2022. Assume that we will sell the stock after two years (at the end of 2023). Please use the attached Value Line Report to estimate the required return, the selling price in two years, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report). Assume that the Risk Free Rate (Rf) is 3.0% and the Market Risk Premium (MRP) is 4.0%. ket Risk Premium (MRP) is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts