Question: 1. What is the standard deviation for Facebook, Inc. (FB)? 2. What is the correlation between FB and COST? 3. What is the beta for

1. What is the standard deviation for Facebook, Inc. (FB)?

2. What is the correlation between FB and COST?

3. What is the beta for Costo Wholesale Corporation (COST)?

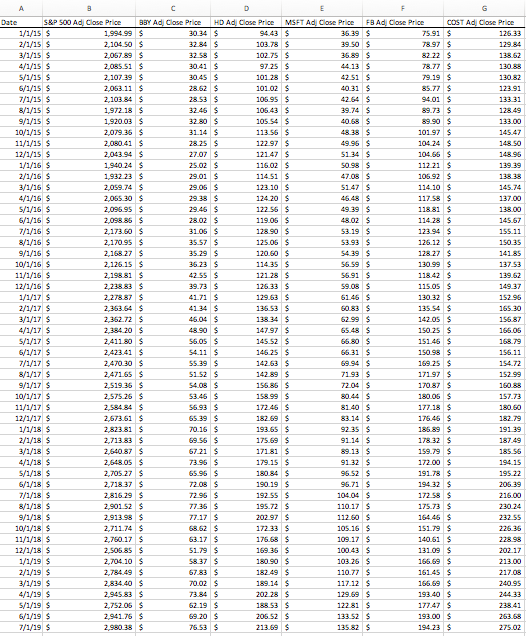

47.00 $ Date S&P 500 Ad Close Price BV Ad Close Price HD Ad Close Price MSFT Ad Close Price FB Ad Close Price COST Ad Close Price 1/1/15 $ 1,994.99 $ 30.34 $ 94.43 $ 36.39 $ 75.91 $ 126.33 2/1/15 $ 2,104.50 $ 32.84 $ 103.78 $ 39.50 $ 78.97 $ 3/1/15 $ 2,057 89S 32.58 $ 102.75 $ 36.89 $ 82.22 $ 4/1/15 $ 2,085.51 $ 97.25 $ 78.77 $ 5/1/15 $ 2,107.39 $ 30.45 S 101 28 $ 42.51 $ 79.19 $ 130 32 6/1/15 $ 2,063.11 $ 28.62 $ 101.02 $ 40.31 $ 85.77 $ 123.91 7/1/15 $ 2,103.84 $ 28 53 $ 106.95 $ 42.64 $ 94.01 $ 13 31 8/1/15 $ 1972.18 $ 32.46 $ 105.43 $ 39.74 $ 89.73 $ 128.49 9/1/15 $ 1920.03 $ 32.80 $ 105.54 $ 40.68 $ 89.90 $ 133.00 10/1/15 $ 2.079.36 $ 31 14 $ 113.56 $ 48.38 $ 101 97 $ 145.47 11/1/15 $ 2080 41 s 28.25 $ 122.97 $ 49.96 $ 104.24 $ 148 SO 12/1/15 s 2,043.94 $ 27.07 $ 121 47 $ 5134 S 104.66 $ 1/1/16 $ 1,940.24 $ 25.02 $ 116.02 $ 5098 $ 112 21 $ 139.39 2/1/16 $ 1,932 233 29.01 $ 114.51 $ 106.92 $ 1838 3/1/16 $ 2,059.74 $ 2906 $ 121 10 $ 5147 S 114.10 $ 145.74 4/1/16 $ 2,055.30 $ 29.38 $ 124.20 $ 46.49 $ 117.58 $ 137.00 5/1/16 $ 2,096.95 $ 29.46 $ 122.56 $ 49.39 $ 118.81 $ 138.00 6/1/16 $ 2,098.86 $ 28.02 $ 119.06 $ 48.02 $ 114.28 $ 145.67 7/1/16 $ 2,173. 31.05 $ 128.90 $ 53.19 $ 123.94 $ 155 11 8/1/16 $ 2,170.95 $ 35.57 S 125.00 $ 53.99 $ 125 12 s 150.35 9/1/16 $ 2.168.27 $ 35.29 $ 120.60 $ 5439 $ 128 27 $ 141.85 10/1/16 $ 2,126.15 $ 36.23 $ 114 35 $ 56.59 $ 130.99 $ 137.53 11/1/16 $ 2,198.81 $ 42.55 $ 121 28 $ 56.91 $ 118.42 $ 139.62 12/1/16 $ 2,238,83 $ 39.73 $ 126,33 $ 59.08 $ 115.05 $ 149 37 1/1/17 $ 2,278.87 $ 41.71 $ 129.63 $ 61.46 $ 130.32 $ 152.95 2/1/17 $ 2,353.64 $ 41 34 $ 136.53 $ 60.83 $ 135.54 $ 165 30 3/1/17 $ 2162.72 $ 46.00 $ 138 34 $ 62.99 $ 142.05 $ 156.87 4/1/17 S 2,384.20 $ 48.90 $ 147.97 $ 150.25 $ 166.05 5/1/17 $ 2,411.80 $ 56.05 $ 145.52 $ 66.80 $ 151.45 $ 168.79 6/1/17 $ 2,423.41 $ 54.11 $ 146.25 $ 66.31 $ 150.98 $ 156.11 7/1/17 $ 2470 30 $ 55.39 $ 142.63 $ 69.94 $ 169.25 $ 154.72 8/1/ 15 2,471.65 $ 51 52 S 171.97 $ 152.99 9/1/17 $ 2,519.36 $ 54.08 $ 156.85 $ 72.04 $ 170.87 $ 160.88 10/1/17 $ 2,575.26 $ 53.46 $ 158.99 $ 80.44 $ 180 06 $ 157.73 11/1/17 $ 2,586 MS 56.93 $ 172.46 $ 81.40 $ 177.18 $ 180.50 12/1/17 $ 2,673.61 $ 65.39 $ 182.69 $ 83.14 $ 176.46 $ 182.79 1/1/18 $ 2,823.81 $ 70.16 $ 193.65 $ 92.35 S 186.89 $ 191 39 2/1/18 $ 2,713.83 $ 69.56 $ 175.69 $ 91.14 $ 178.32 $ 187.49 3/1/18 $ 2,640.87 $ 67.21 $ 171.81 $ 89.13 $ 159.79 $ 185 56 4/1/18 S 2,648.05 $ 73.95 $ 179.15 $ 172.00 $ 194.15 5/1/18 $ 2,705.27 $ 65.96 $ 180 84 S 95 52 $ 191.78 $ 195.22 6/1/18 $ 2,718.37 $ 72.08 $ 190.19 $ 96.71 $ 194 32 $ 206 39 7/1/18 $ 2,816.29 $ 72.96 $ 192 55 $ 104.04 $ 172.58 $ 216.00 8/1/18 $ 2.901 52 $ 77.36 $ 195.72 $ 110.17 $ 175.73 $ 9/1/18 $ 2,913.88 $ 77.17 $ 202.97 $ 112.60 $ 164.46 $ 232.55 10/1/18 $ 2,711.74 $ 68 62 $ 172.33 $ 105.16 $ 151.79 $ 226.36 11/1/18 $ 2,760 17 S 63.17 $ 176.68 $ 109.17 $ 140.61 $ 228.98 12/1/18 $ 2.50685 $ 51.79 $ 169 M S 131.09 $ 202.17 1/1/19 $ 2,704.10 $ 5837 $ 180.90 $ 103 25 $ 166.59 $ 213.00 2/1/19 $ 2,784.49 $ 67.83 $ 182.49 $ 110.77 $ 161 45 $ 217.08 3/1/19 $ 2.834.40 $ 2002 $ 189.14 $ 117.12 $ 166.69 $ 24095 4/1/19 $ 2.945.83 $ 73.84 $ 202.28 $ 129.69 $ 193.40 $ S/1/19 $ 2,752.06 $ 62.19 $ 188.53 $ 122.81 $ 177.47 $ 238.41 6/1/19 $ 2.941.76 $ 69.20 $ 206.52 $ 133.52 $ 193.00 $ 263.68 7/1/19 $ 2.980 19 $ 76.53 $ 213.69 $ 135.82 $ 194 23 $ 275.02 142.89 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts