Question: 1. What is the WACC for this project? 2. What is the NPV of this project? (express answer in millions, so 1,000,000 would be 1.00)

1. What is the WACC for this project?

1. What is the WACC for this project?

2. What is the NPV of this project? (express answer in millions, so 1,000,000 would be 1.00)

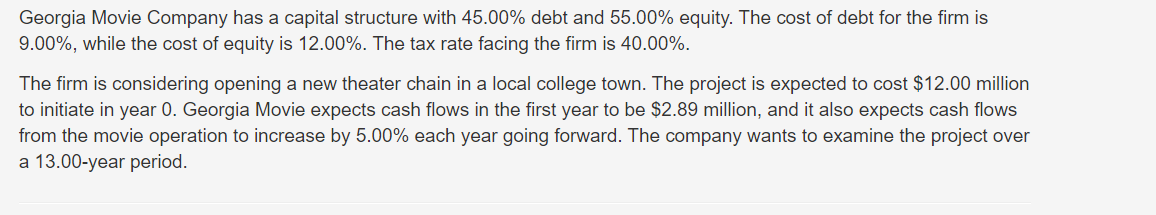

Georgia Movie Company has a capital structure with 45.00% debt and 55.00% equity. The cost of debt for the firm is 9.00%, while the cost of equity is 12.00%. The tax rate facing the firm is 40.00%. The firm is considering opening a new theater chain in a local college town. The project is expected to cost $12.00 million to initiate in year 0. Georgia Movie expects cash flows in the first year to be $2.89 million, and it also expects cash flows from the movie operation to increase by 5.00% each year going forward. The company wants to examine the project over a 13.00-year period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts