Question: 1) What main differences do you make between GS Large Cap Value A and MS Mid Cap Growth A? Explain clearly how you may differentiate

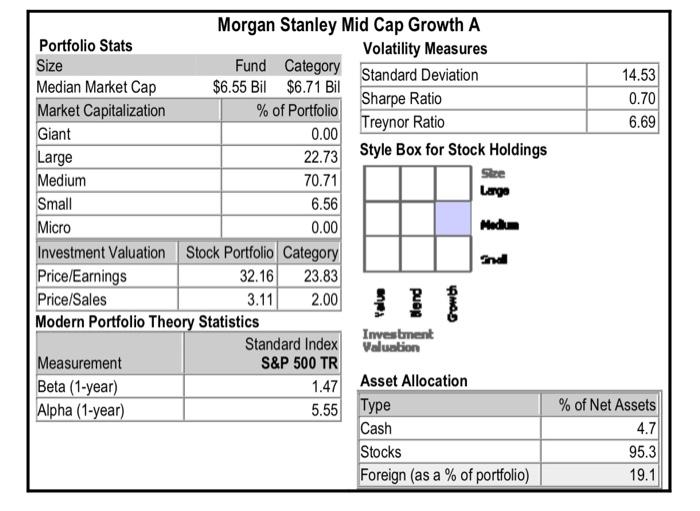

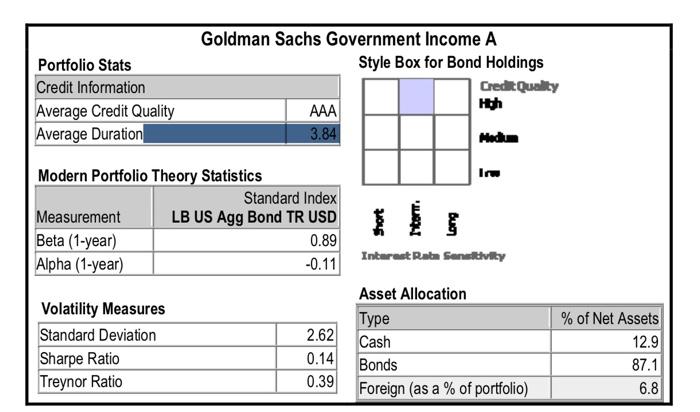

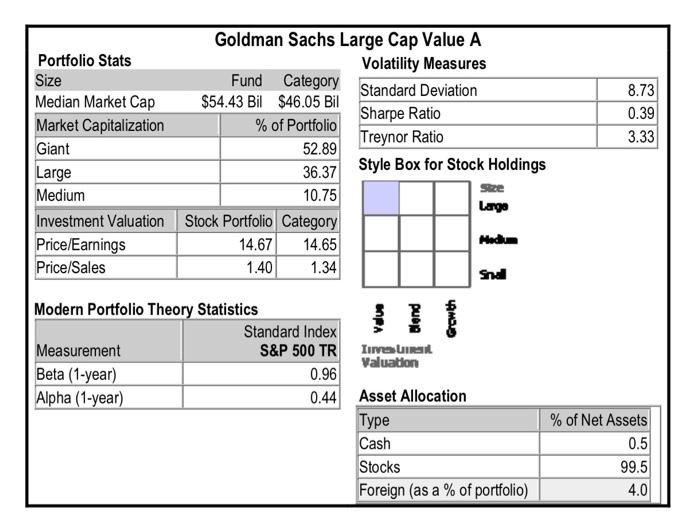

Size 14.53 0.70 6.69 Morgan Stanley Mid Cap Growth A Portfolio Stats Volatility Measures Fund Category Standard Deviation Median Market Cap $6.55 Bil $6.71 Bil Sharpe Ratio Market Capitalization % of Portfolio Treynor Ratio Giant 0.00 Large 22.73 Style Box for Stock Holdings Medium 70.71 Size Large Small 6.56 Micro 0.00 Medium Investment Valuation Stock Portfolio Category indd Price/Earnings 32.16 23.83 Price/Sales 3.11 2.00 Modern Portfolio Theory Statistics Investment Standard Index Valuation Measurement S&P 500 TR Beta (1-year) 1.47 Asset Allocation Alpha (1-year) Cash Stocks Foreign (as a % of portfolio) 5.55 Type % of Net Assets 4.7 95.3 19.1 Portfolio Stats Credit Information Average Credit Quality Average Duration Goldman Sachs Government Income A Style Box for Bond Holdings Credit Quality AAA 3.84 Medium Modern Portfolio Theory Statistics Standard Index Measurement LB US Agg Bond TR USD Beta (1-year) 0.89 Alpha (1-year) -0.11 Interest Rate Senelity Volatility Measures Standard Deviation Sharpe Ratio Treynor Ratio 2.62 0.14 0.39 Asset Allocation Type Cash Bonds Foreign (as a % of portfolio) % of Net Assets 12.9 87.1 6.8 8.73 0.39 3.33 Goldman Sachs Large Cap Value A Portfolio Stats Volatility Measures Size Fund Category Standard Deviation Median Market Cap $54.43 Bil $46.05 Bil Market Capitalization % of Portfolio Sharpe Ratio Treynor Ratio Giant 52.89 Large 36.37 Style Box for Stock Holdings Medium 10.75 Lago Investment Valuation Stock Portfolio Category Price/Earnings 14.67 14.65 Med Price/Sales 1.40 1.34 Snd Modern Portfolio Theory Statistics Standard Index Measurement S&P 500 TR Turvas Valuation Beta (1-year) 0.96 Alpha (1-year) 0.44 Asset Allocation Type Cash Stocks Foreign (as a % of portfolio) % of Net Assets 0.5 99.5 4.0 Size 14.53 0.70 6.69 Morgan Stanley Mid Cap Growth A Portfolio Stats Volatility Measures Fund Category Standard Deviation Median Market Cap $6.55 Bil $6.71 Bil Sharpe Ratio Market Capitalization % of Portfolio Treynor Ratio Giant 0.00 Large 22.73 Style Box for Stock Holdings Medium 70.71 Size Large Small 6.56 Micro 0.00 Medium Investment Valuation Stock Portfolio Category indd Price/Earnings 32.16 23.83 Price/Sales 3.11 2.00 Modern Portfolio Theory Statistics Investment Standard Index Valuation Measurement S&P 500 TR Beta (1-year) 1.47 Asset Allocation Alpha (1-year) Cash Stocks Foreign (as a % of portfolio) 5.55 Type % of Net Assets 4.7 95.3 19.1 Portfolio Stats Credit Information Average Credit Quality Average Duration Goldman Sachs Government Income A Style Box for Bond Holdings Credit Quality AAA 3.84 Medium Modern Portfolio Theory Statistics Standard Index Measurement LB US Agg Bond TR USD Beta (1-year) 0.89 Alpha (1-year) -0.11 Interest Rate Senelity Volatility Measures Standard Deviation Sharpe Ratio Treynor Ratio 2.62 0.14 0.39 Asset Allocation Type Cash Bonds Foreign (as a % of portfolio) % of Net Assets 12.9 87.1 6.8 8.73 0.39 3.33 Goldman Sachs Large Cap Value A Portfolio Stats Volatility Measures Size Fund Category Standard Deviation Median Market Cap $54.43 Bil $46.05 Bil Market Capitalization % of Portfolio Sharpe Ratio Treynor Ratio Giant 52.89 Large 36.37 Style Box for Stock Holdings Medium 10.75 Lago Investment Valuation Stock Portfolio Category Price/Earnings 14.67 14.65 Med Price/Sales 1.40 1.34 Snd Modern Portfolio Theory Statistics Standard Index Measurement S&P 500 TR Turvas Valuation Beta (1-year) 0.96 Alpha (1-year) 0.44 Asset Allocation Type Cash Stocks Foreign (as a % of portfolio) % of Net Assets 0.5 99.5 4.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts