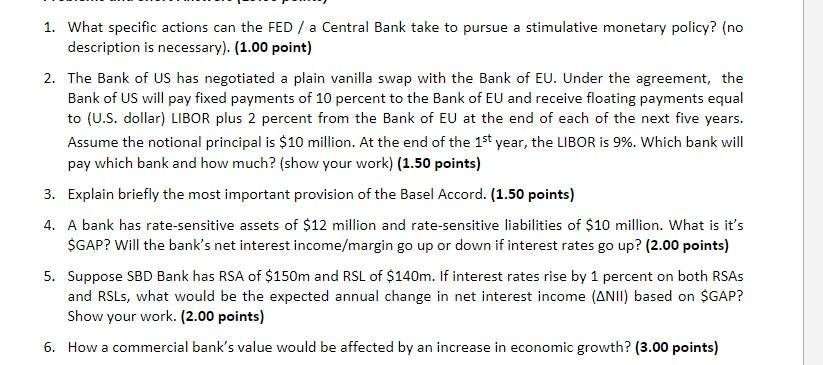

Question: 1. What specific actions can the FED / a Central Bank take to pursue a stimulative monetary policy? (no description is necessary). (1.00 point) 2.

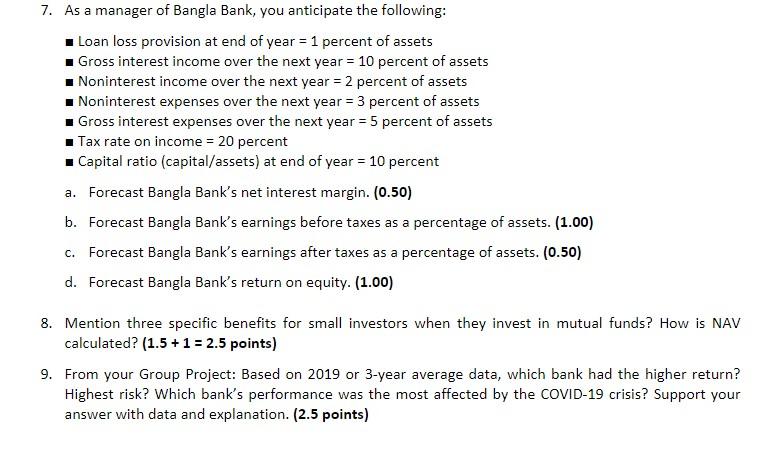

1. What specific actions can the FED / a Central Bank take to pursue a stimulative monetary policy? (no description is necessary). (1.00 point) 2. The Bank of US has negotiated a plain vanilla swap with the Bank of EU. Under the agreement, the Bank of US will pay fixed payments of 10 percent to the Bank of EU and receive floating payments equal to (U.S. dollar) LIBOR plus 2 percent from the Bank of EU at the end of each of the next five years. Assume the notional principal is $10 million. At the end of the 1st year, the LIBOR is 9%. Which bank will pay which bank and how much? (show your work) (1.50 points) 3. Explain briefly the most important provision of the Basel Accord. (1.50 points) 4. A bank has rate-sensitive assets of $12 million and rate-sensitive liabilities of $10 million. What is it's $GAP? Will the bank's net interest income/margin go up or down if interest rates go up? (2.00 points) 5. Suppose SBD Bank has RSA of $150m and RSL of $140m. If interest rates rise by 1 percent on both RSAS and RSLs, what would be the expected annual change in net interest income (ANTI) based on SGAP? Show your work. (2.00 points) 6. How a commercial bank's value would be affected by an increase in economic growth? (3.00 points) 7. As a manager of Bangla Bank, you anticipate the following: Loan loss provision at end of year = 1 percent of assets Gross interest income over the next year = 10 percent of assets Noninterest income over the next year = 2 percent of assets Noninterest expenses over the next year = 3 percent of assets Gross interest expenses over the next year = 5 percent of assets Tax rate on income = 20 percent - Capital ratio (capital/assets) at end of year = 10 percent a. Forecast Bangla Bank's net interest margin. (0.50) b. Forecast Bangla Bank's earnings before taxes as a percentage of assets. (1.00) c. Forecast Bangla Bank's earnings after taxes as a percentage of assets. (0.50) d. Forecast Bangla Bank's return on equity. (1.00) 8. Mention three specific benefits for small investors when they invest in mutual funds? How is NAV calculated? (1.5 + 1 = 2.5 points) 9. From your Group Project: Based on 2019 or 3-year average data, which bank had the higher return? Highest risk? Which bank's performance was the most affected by the COVID-19 crisis? Support your answer with data and explanation. (2.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts