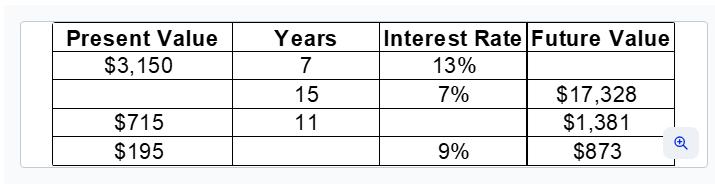

Question: 1. What values go in the missing rows? 2) You are scheduled to receive $13,000 in two years. When you receive it, you

- 1. What values go in the missing rows?

2) You are scheduled to receive $13,000 in two years. When you receive it, you will invest if for six more years at 7.5% per year. How much will you have in eight years?

- 3) If the discount rate is 10% what is the present value fo the cash flows?

Year Cash Flow

1 $680

2 $490

3 $975

4 $1,160

4) The discount rate is 8%, what is the future value of these cash flows in year 4?

Year Cash Flow

1 $985

2 $1,160

3 $1,325

4 $1,495

5) You deposit $5,000 at the end of each year for 20 years into an account paying 9.6% interest, how much money will you have in the account in 20 years?

6) Lycan Inc. has 7% coupon bonds on the market that have 9 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the YTM on these bonds is 8.4%, what is the current bond price?

7) The Timberlake Co. has 7% coupon bonds in the market with 9 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the bonds currently sell for $961.50, what is the YTM.

8) Volbeat Co. has bonds on the market with 10.5 years to maturity, a YTM of 6.2%, a par value of $1,000, and a current price of $945. The bonds make semiannual payments. What must the coupon rate be on the bonds?

9) If Treasury bills are currently paying 4.5% and the inflation rate is 1.6%, what is the approximate real rate of interest? The exact real rate?

10) Gilmore Inc. just paid a divident of $2.35 per share on its stock. The dividends are expected to grow at a constant rate of 4.1% per year, indefinitely. If investors require a return a 10.4% on this stock, what is the current price?

11) Mitchell Inc. has a constant 4.6% percent growth rate in its dividends. If the company has a dividend yield of 5.8%, what is the required return on the company's stock.

12) Smiling Elephant, Inc., has an issue of preferred stock outstanding that pays a $3.45 dividend every year, in perpetuity? If this issue currently sells for $77.32 per share, what is the required return?

13)The Sleeping Flower Co. has earning of $2.65 per share. The benchmark PE for the company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21?

Present Value $3,150 $715 $195 Years 7 15 11 Interest Rate Future Value 13% 7% 9% $17,328 $1,381 $873 Q

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

1 The missing values in the table are as follows Present Value 3150 Years 7 Interest Rate 13 Future Value 17328 2 To calculate the future value after 8 years use the compound interest formula Future V... View full answer

Get step-by-step solutions from verified subject matter experts