Question: 1. What would be the total interest expense recognized for the bond issue over its full term? (Hint: this question is not asking for the

1. What would be the total interest expense recognized for the bond issue over its full term? (Hint: this question is not asking for the sum of all interest expenses recorded every period.)

1. What would be the total interest expense recognized for the bond issue over its full term? (Hint: this question is not asking for the sum of all interest expenses recorded every period.)

2. Assume Lopez Corporation calls the bonds at 103 immediately after the interest payment on 1/1/2023 and retires them. Provide the journal entry for the early extinguishment of the bonds.

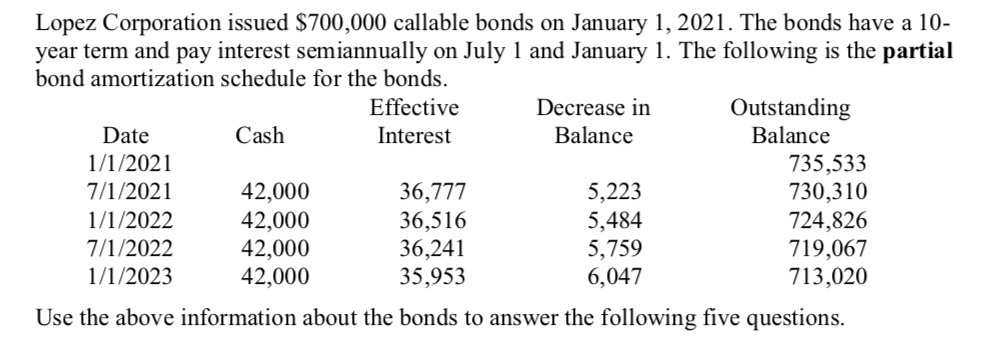

Lopez Corporation issued $700,000 callable bonds on January 1, 2021. The bonds have a 10- year term and pay interest semiannually on July 1 and January 1. The following is the partial bond amortization schedule for the bonds. Effective Decrease in Outstanding Date Cash Interest Balance Balance 1/1/2021 735,533 7/1/2021 42,000 36,777 5,223 730,310 1/1/2022 42,000 36,516 5,484 724,826 7/1/2022 42,000 36,241 5,759 719,067 1/1/2023 42,000 35,953 6,047 713,020 Use the above information about the bonds to answer the following five questions

Step by Step Solution

There are 3 Steps involved in it

To answer the questions we will work through the calculations step by step 1 Total Interest Expense ... View full answer

Get step-by-step solutions from verified subject matter experts