Question: 1. When a partnership is liquidated, how is the final distribution of partnership cash made to the partners? a. Equally b. According to the profit

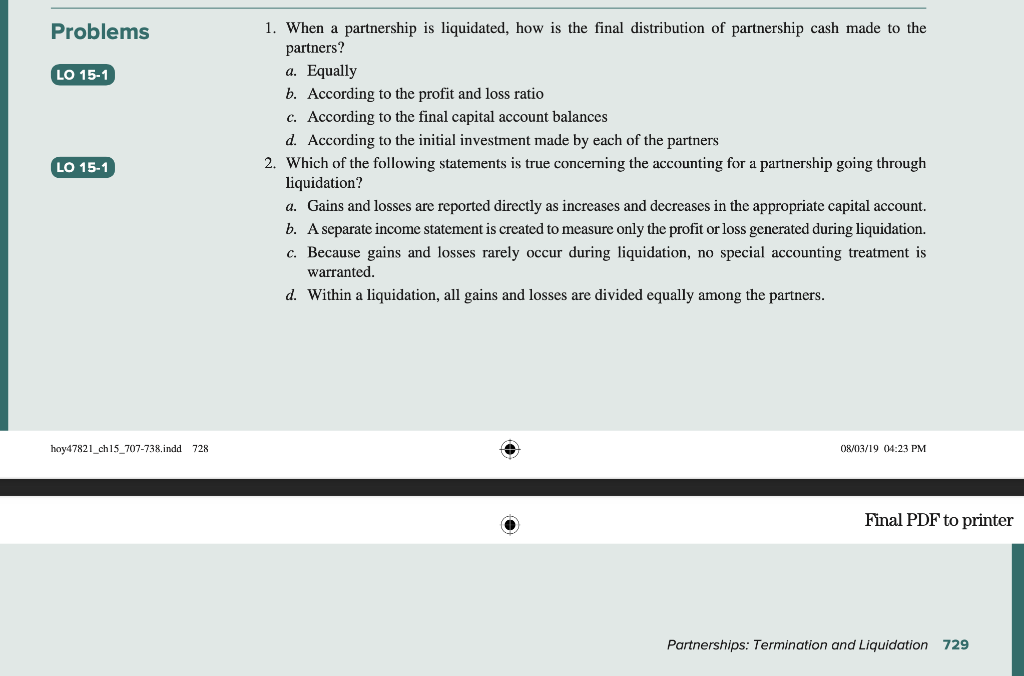

1. When a partnership is liquidated, how is the final distribution of partnership cash made to the partners? a. Equally b. According to the profit and loss ratio c. According to the final capital account balances d. According to the initial investment made by each of the partners 2. Which of the following statements is true concerning the accounting for a partnership going through liquidation? a. Gains and losses are reported directly as increases and decreases in the appropriate capital account. b. A separate income statement is created to measure only the profit or loss generated during liquidation. c. Because gains and losses rarely occur during liquidation, no special accounting treatment is warranted. d. Within a liquidation, all gains and losses are divided equally among the partners. 08/03/1904:23PM Final PDF to pr Partnerships: Termination and Liquidation 729

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts