Question: 1. When determining whether to recognize an uncertain tax position, which one of the following is incorrect? A. The firm needs to refer to authoritative

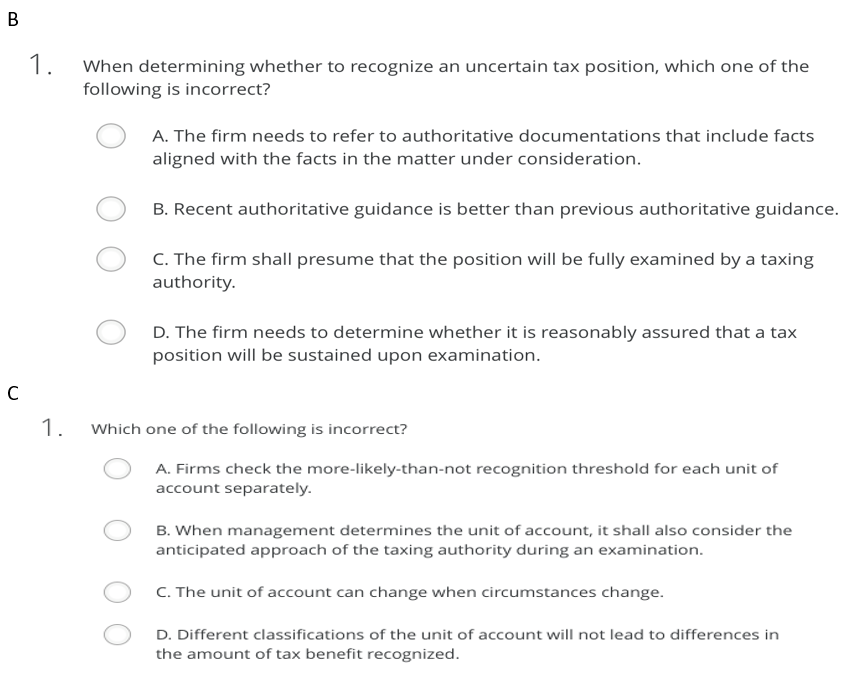

1. When determining whether to recognize an uncertain tax position, which one of the following is incorrect? A. The firm needs to refer to authoritative documentations that include facts aligned with the facts in the matter under consideration. B. Recent authoritative guidance is better than previous authoritative guidance. C.The firm shall presume that the position will be fully examined by a taxing authority. D. The firm needs to determine whether it is reasonably assured that a tax position will be sustained upon examination. 1 Which one of the following is incorrect? A. Firms check the more-likely-than-not recognition threshold for each unit of account separately B. When management determines the unit of account, it shall also consider the anticipated approach of the taxing authority during an examination. C. The unit of account can change when circumstances change D. Different classifications of the unit of account will not lead to differences in the amount of tax benefit recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts