Question: 1. When faced with choosing one project among several (mutually exclusive projects), if NPV and IRR disagree on which project to take, we should: Optional

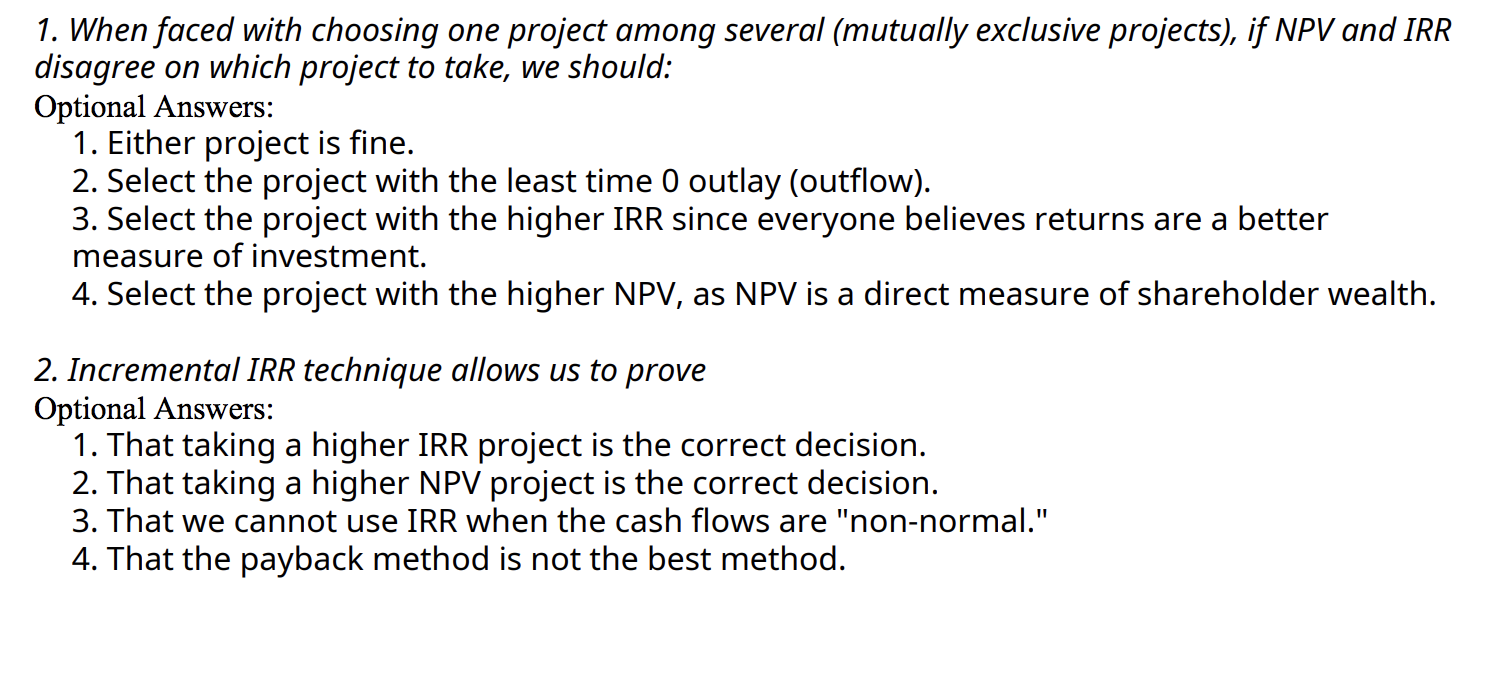

1. When faced with choosing one project among several (mutually exclusive projects), if NPV and IRR disagree on which project to take, we should: Optional Answers: 1. Either project is fine. 2. Select the project with the least time 0 outlay (outflow). 3. Select the project with the higher IRR since everyone believes returns are a better measure of investment. 4. Select the project with the higher NPV, as NPV is a direct measure of shareholder wealth. 2. Incremental IRR technique allows us to prove Optional Answers: 1. That taking a higher IRR project is the correct decision. 2. That taking a higher NPV project is the correct decision. 3. That we cannot use IRR when the cash flows are "non-normal." 4. That the payback method is not the best method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts