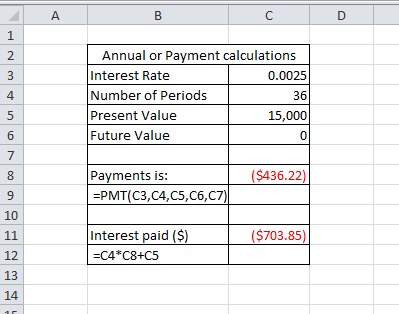

Question: 1. When in cell C3 the interest rate is 1% or 0.01 the annual worth of this alternative is: 2. When in cell C4 the

1. When in cell C3 the interest rate is 1% or 0.01 the annual worth of this alternative is:

2. When in cell C4 the number of periods is changed from 36 to 48 payments the annual worth of this alternative is:

3. When in cell C5 the present value is changed from $15,000 to $10,000 (due to a $5,000 down payment) the annual worth of this alternative is:

4. Which is the best alternative or where you pay less interest in dollars?

1 Annual or Payment calculations Interest Rate Number of Periods Present Value Future Value 0.0025 36 15,000 0 4 Payments is: ($436.22) PMT(C3,C4,C5,C6,C7) 10 ($703.85) Interest paid ($ -C4*C8+C5 12 13 1AStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock