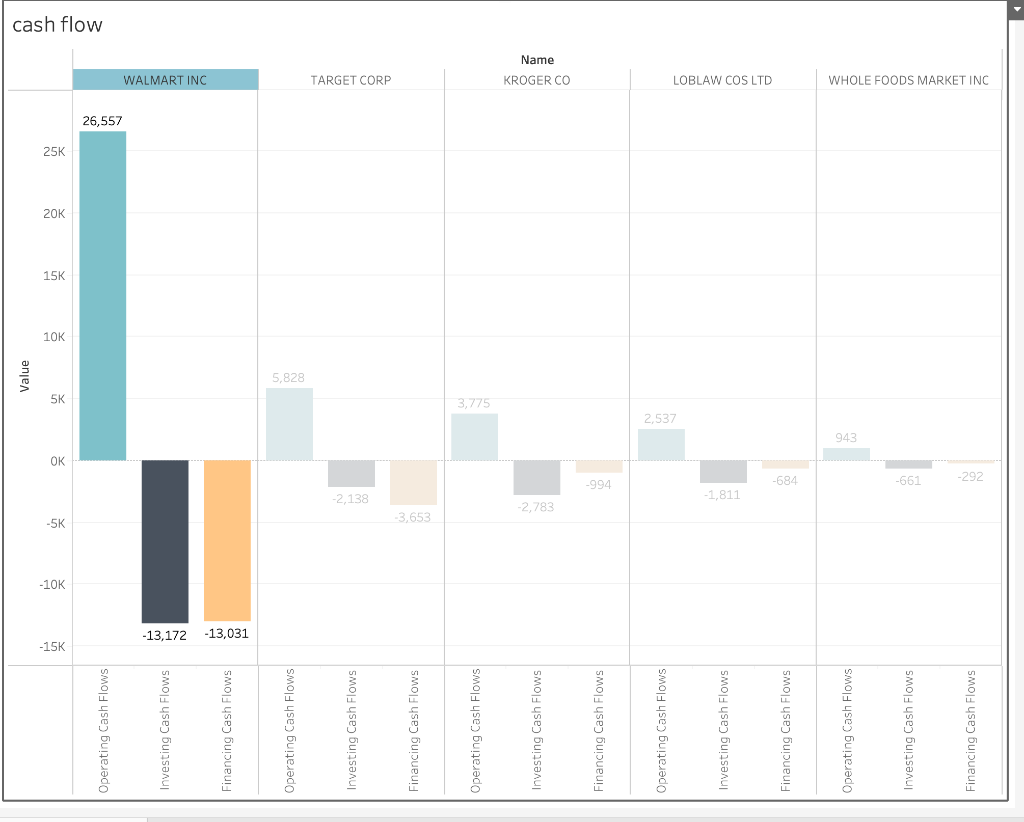

Question: 1. When looking at the cash balance by hovering over the figure, it seems that Whole Foods Markets and Krogers are similar. Please explain why

1. When looking at the cash balance by hovering over the figure, it seems that Whole Foods Markets and Krogers are similar. Please explain why their average operating cash inflows are so different.

2. People say that for retailers, it is possible to make a profit but go bankrupt. That is, managing cash flows is key for retailers given the nature of its day-to-day buy and sell business operations. Without the cash, the business will stop running. Given that Walmart is about 5 times bigger than Target in terms of total assets, do you think Walmart has enough cash flows compared to Target based on the visualization?

HELP.

Value -15K -10K -5K OK 5K 10K 15K 20K 25K cash flow Operating Cash Flows 26,557 Investing Cash Flows -13,172 WALMART INC Financing Cash Flows -13,031 Operating Cash Flows 5,828 Investing Cash Flows -2,138 TARGET CORP Financing Cash Flows -3,653 Operating Cash Flows 3,775 Investing Cash Flows -2,783 KROGER CO Name Financing Cash Flows -994 Operating Cash Flows 2,537 Investing Cash Flows -1,811 LOBLAW COS LTD Financing Cash Flows -684 Operating Cash Flows 943 Investing Cash Flows 199- WHOLE FOODS MARKET INC Financing Cash Flows -292

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts