Question: 1. When Retained Earnings have been exhausted as a source of financing and new common stock must be issued, the firm's Weighted Average Cost of

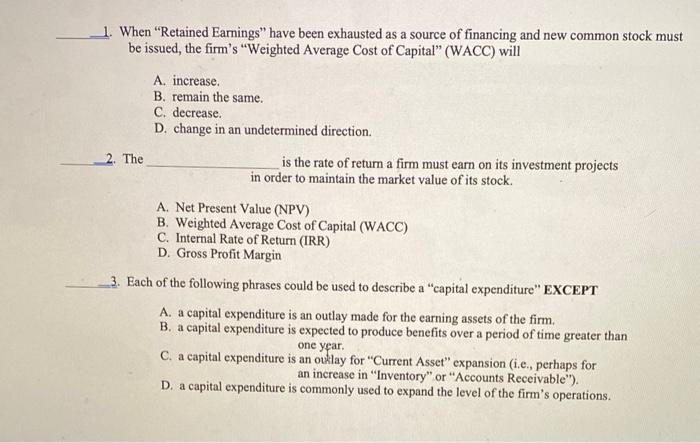

1. When "Retained Earnings" have been exhausted as a source of financing and new common stock must be issued, the firm's "Weighted Average Cost of Capital" (WACC) will A. increase. B. remain the same. C. decrease. D. change in an undetermined direction. 2. The is the rate of return a firm must earn on its investment projects in order to maintain the market value of its stock. A. Net Present Value (NPV) B. Weighted Average Cost of Capital (WACC) C. Internal Rate of Return (IRR) D. Gross Profit Margin 3. Each of the following phrases could be used to describe a "capital expenditure" EXCEPT A. a capital expenditure is an outlay made for the earning assets of the firm. B. a capital expenditure is expected to produce benefits over a period of time greater than one year. C. a capital expenditure is an ouklay for "Current Asset" expansion (i.e., perhaps for an increase in "Inventory" or "Accounts Receivable"). D. a capital expenditure is commonly used to expand the level of the firm's operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts