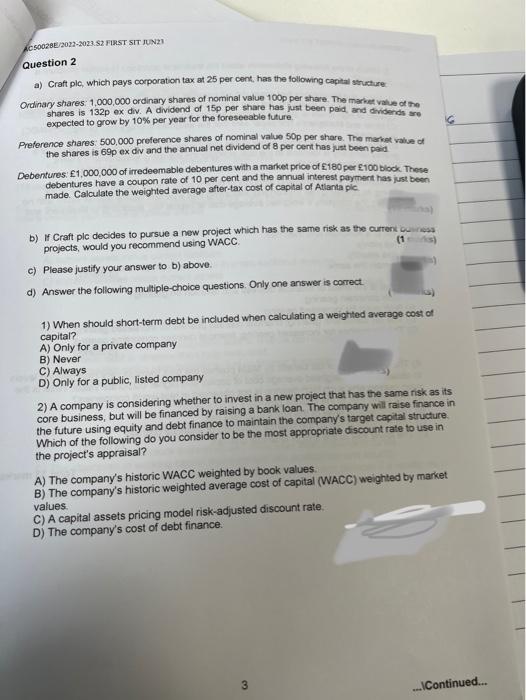

Question: 1) When should short-term debt be included when calculating a weighted average cost of capital? A) Only for a private company B) Never C) Always

1) When should short-term debt be included when calculating a weighted average cost of capital? A) Only for a private company B) Never C) Always D) Only for a public, listed company 2) A company is considering whether to invest in a new project that has the same risk as its core business, but will be financed by raising a bank loan. The company will raise finance in the future using equity and debt finance to maintain the company's target capital structure. Which of the following do you consider to be the most appropriate discount rate to use in the project's appraisal? A) The company's historic WACC weighted by book values. B) The company's historic weighted average cost of capital (WACC) weighted by market values. C) A capital assets pricing model risk-adjusted discount rate D) The company's cost of debt finance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts