Question: 1. When the balance sheet is translated by the current rate method, how much translation adjustment would the U.S. parent's balance sheet have before the

1. When the balance sheet is translated by the current rate method, how much translation adjustment would the U.S. parent's balance sheet have before the exchange rate changes?

| 2.-When the balance sheet is translated by the current rate method, how much translation adjustment would the U.S. parent's balance sheet have after the exchange rate changes |

3.- How much is the net exposed assets in yen when the current rate method is used?

4.- When the balance sheet is translated by the temporal method, how much translation adjustment would the U.S. parent's income statement have before the exchange rate changes?

5.- When the balance sheet is translated by the current rate method, how much translation adjustment would the U.S. parent's income statement have after the exchange rate changes?

6.- How much is the net exposed assets in yen when the current rate method is used?

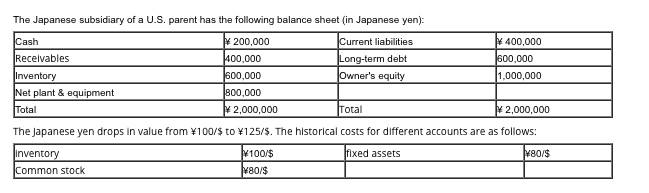

The Japanese subsidiary of a U.S. parent has the following balance sheet (in Japanese yen): Cash Recelvables nventory Net plant & equipment Total The Japanese yen drops in value from 100/$ to 125/$. The historical costs for different accounts are as follows: 00,000 00,000 00,000 wner's equity ,000,000 2,000,000 Total 2,000,000 100/ ixed assets 80/S nventory Common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts