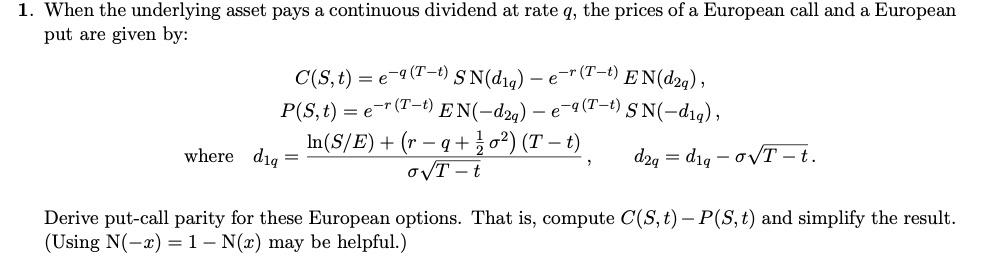

Question: 1. When the underlying asset pays a continuous dividend at rate q, the prices of a European call and a European put are given by:

1. When the underlying asset pays a continuous dividend at rate q, the prices of a European call and a European put are given by: C(S,t) = e-9 (T-1) S N(diq) - e-T(T-t) E N(d2q), P(S,t) = @=r(T-1) EN(-d2q) - e-9(T-t) S N(-d19), In(S/E) + (r 9+} 0) (T t) where dig d2q = diq - OVT-t. OVT-t Derive put-call parity for these European options. That is, compute C(S,t)- P(S,t) and simplify the result. (Using N(-x) = 1 - N(2) may be helpful.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts