Question: 1. Which bond issue in Exhibit 3 has the highest bond rating? 2. Which bond has the longest maturity date? 3. What was Boeing's highest

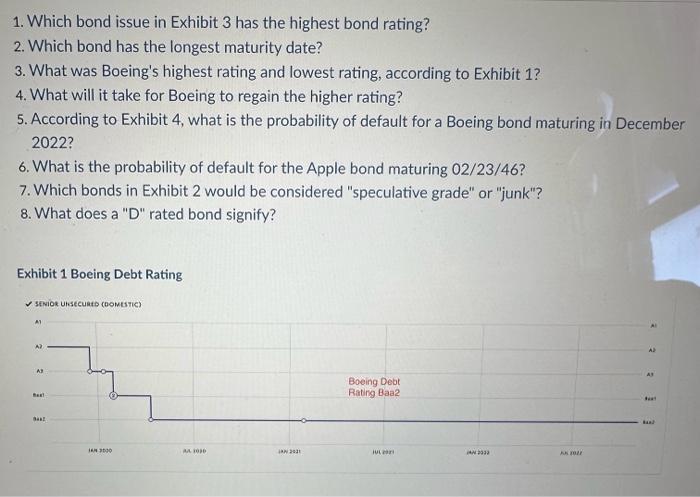

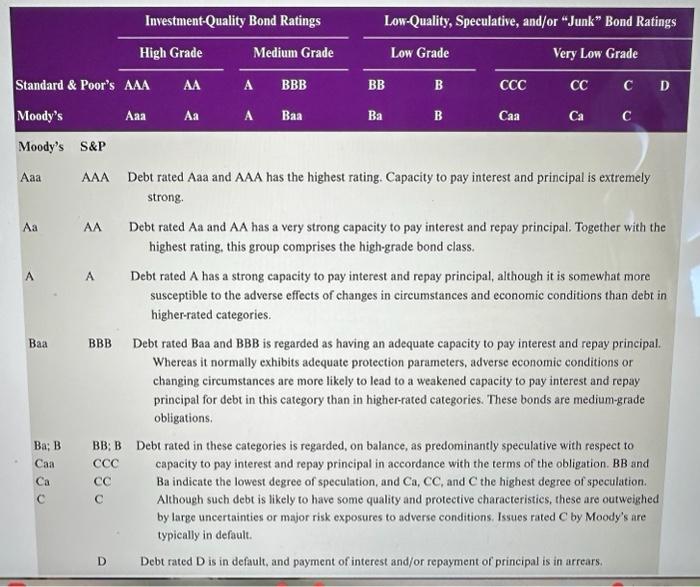

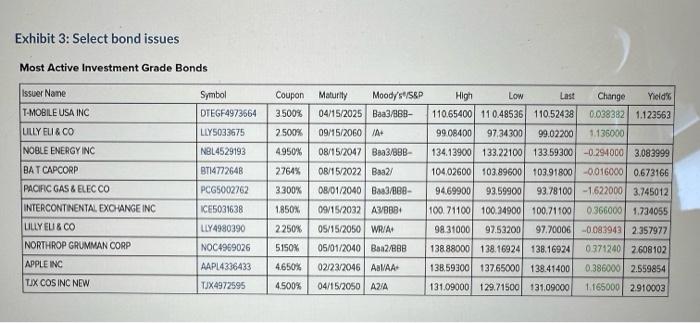

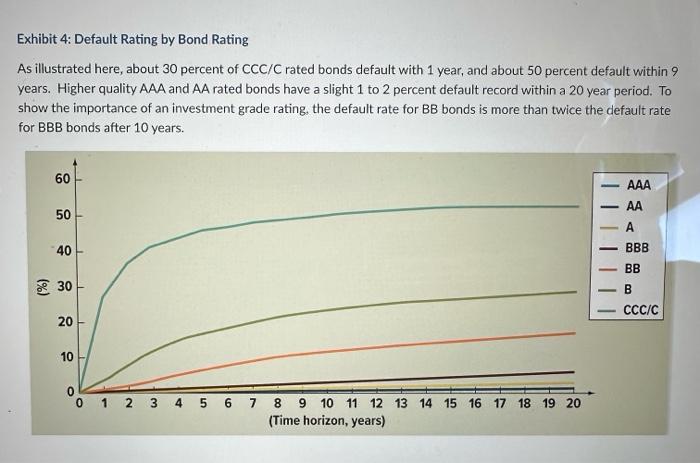

1. Which bond issue in Exhibit 3 has the highest bond rating? 2. Which bond has the longest maturity date? 3. What was Boeing's highest rating and lowest rating, according to Exhibit 1? 4. What will it take for Boeing to regain the higher rating? 5. According to Exhibit 4, what is the probability of default for a Boeing bond maturing in December 2022? 6. What is the probability of default for the Apple bond maturing 02/23/46 ? 7. Which bonds in Exhibit 2 would be considered "speculative grade" or "junk"? 8. What does a "D" rated bond signify? Exhibit 1 Boeing Debt Rating AAA Debt rated Aaa and AAA has the highest rating. Capacity to pay interest and principal is extremely strong. a AA Debt rated Aa and AA has a very strong capacity to pay interest and repay principal. Together with the highest rating, this group comprises the high-grade bond class. A Debt rated A has a strong capacity to pay interest and repay principal, although it is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than debt in higher-rated categories. BBB Debt rated Baa and BBB is regarded as having an adequate capacity to pay interest and repay principal. Whereas it normally exhibits adequate protection parameters, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity to pay interest and repay principal for debt in this category than in higher-rated categories. These bonds are medium-grade obligations. Ba; B BB; B Debt rated in these categories is regarded, on balance, as predominantly speculative with respect to Caa CCC capacity to pay interest and repay principal in accordance with the terms of the obligation. BB and CaCCBa indicate the lowest degree of speculation, and Ca,CC, and C the highest degree of speculation. C C Although such debt is likely to have some quality and protective characteristies, these are outweighed by large uncertainties or major risk exposures to adverse conditions. Issues rated C by Moody's are typically in default. Exhibit 3: Select bond issues Most Active Investment Grade Bonds Exhibit 4: Default Rating by Bond Rating As illustrated here, about 30 percent of CCC/C rated bonds default with 1 year, and about 50 percent default within 9 years. Higher quality AAA and AA rated bonds have a slight 1 to 2 percent default record within a 20 year period. To show the importance of an investment grade rating, the default rate for BB bonds is more than twice the default rate for BBB bonds after 10 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts