Question: 1. Which case corresponds to optimal WACC? 2. Why does optimal WACC correspond to an entity's optimum leverage for all stakeholders? 3. What is the

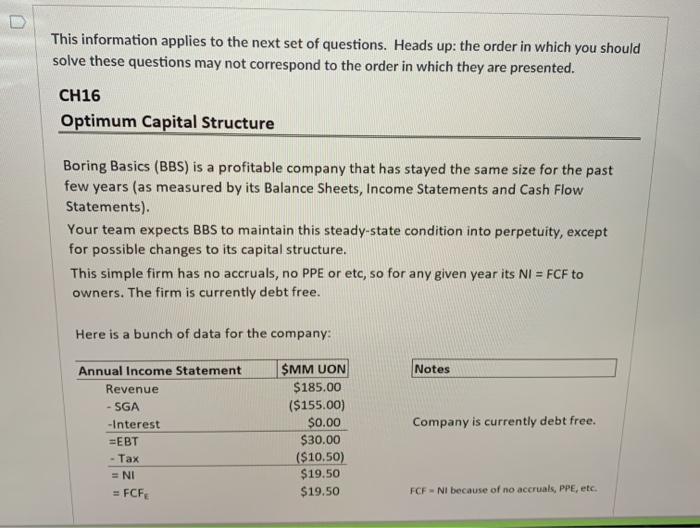

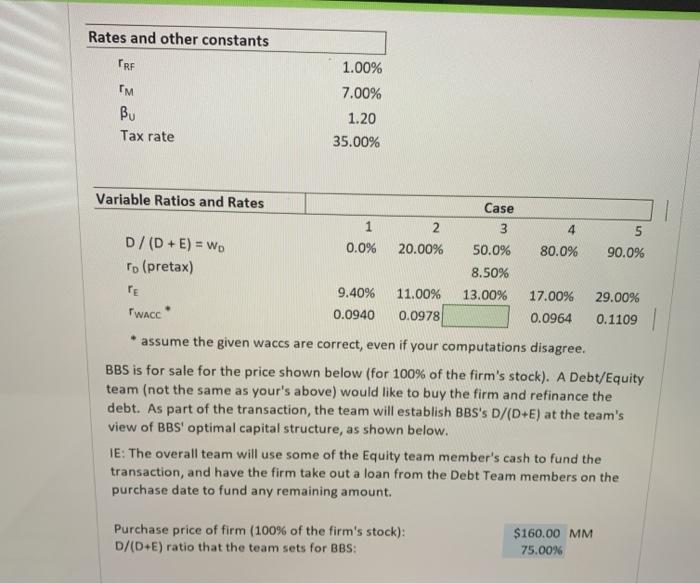

This information applies to the next set of questions. Heads up: the order in which you should solve these questions may not correspond to the order in which they are presented. CH16 Optimum Capital Structure Boring Basics (BBS) is a profitable company that has stayed the same size for the past few years (as measured by its Balance Sheets, Income Statements and Cash Flow Statements) Your team expects BBS to maintain this steady-state condition into perpetuity, except for possible changes to its capital structure. This simple firm has no accruals, no PPE or etc, so for any given year its NI = FCF to owners. The firm is currently debt free. Here is a bunch of data for the company: Notes Annual Income Statement Revenue - SGA -Interest =EBT - Tax = NI = FCF $MM UON $185.00 ($155.00) $0.00 $30.00 ($10.50) $19.50 $19.50 Company is currently debt free. FCFNI because of no accruals, PPE, etc. Rates and other constants TRF Bu Tax rate 1.00% 7.00% 1.20 35.00% Variable Ratios and Rates Case 1 0.0% 2 20.00% 80.0% 90.0% D/(D+E) = WD To (pretax) PE 50.0% 8.50% 13.00% 9.40% 0.0940 11.00% 0.0978 WACC 17.00% 0.0964 29.00% 0.1109 assume the given waces are correct, even if your computations disagree. BBS is for sale for the price shown below (for 100% of the firm's stock). A Debt/Equity team (not the same as your's above) would like to buy the firm and refinance the debt. As part of the transaction, the team will establish BBS's D/(D+E) at the team's view of BBS' optimal capital structure, as shown below. IE: The overall team will use some of the Equity team member's cash to fund the transaction, and have the firm take out a loan from the Debt Team members on the purchase date to fund any remaining amount. Purchase price of firm (100% of the firm's stock): D/(D+E) ratio that the team sets for BBS: $160.00 MM 75.00% This information applies to the next set of questions. Heads up: the order in which you should solve these questions may not correspond to the order in which they are presented. CH16 Optimum Capital Structure Boring Basics (BBS) is a profitable company that has stayed the same size for the past few years (as measured by its Balance Sheets, Income Statements and Cash Flow Statements) Your team expects BBS to maintain this steady-state condition into perpetuity, except for possible changes to its capital structure. This simple firm has no accruals, no PPE or etc, so for any given year its NI = FCF to owners. The firm is currently debt free. Here is a bunch of data for the company: Notes Annual Income Statement Revenue - SGA -Interest =EBT - Tax = NI = FCF $MM UON $185.00 ($155.00) $0.00 $30.00 ($10.50) $19.50 $19.50 Company is currently debt free. FCFNI because of no accruals, PPE, etc. Rates and other constants TRF Bu Tax rate 1.00% 7.00% 1.20 35.00% Variable Ratios and Rates Case 1 0.0% 2 20.00% 80.0% 90.0% D/(D+E) = WD To (pretax) PE 50.0% 8.50% 13.00% 9.40% 0.0940 11.00% 0.0978 WACC 17.00% 0.0964 29.00% 0.1109 assume the given waces are correct, even if your computations disagree. BBS is for sale for the price shown below (for 100% of the firm's stock). A Debt/Equity team (not the same as your's above) would like to buy the firm and refinance the debt. As part of the transaction, the team will establish BBS's D/(D+E) at the team's view of BBS' optimal capital structure, as shown below. IE: The overall team will use some of the Equity team member's cash to fund the transaction, and have the firm take out a loan from the Debt Team members on the purchase date to fund any remaining amount. Purchase price of firm (100% of the firm's stock): D/(D+E) ratio that the team sets for BBS: $160.00 MM 75.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts