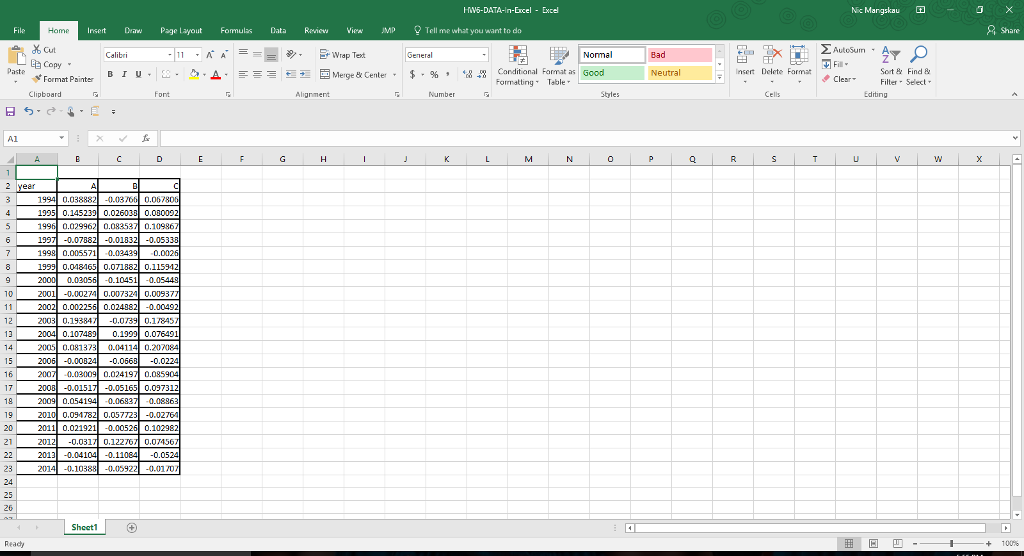

Question: 1. Which farm has had the highest average return? Which would be the riskiest? What are you basing this on? 2. In an early lecture

1. Which farm has had the highest average return? Which would be the riskiest? What are you basing this on? 2. In an early lecture in this class, we discussed the coefficient of variation (CV in your book, COV in other texts). Thinking of the average return in this problem as a benefit and the standard deviation as the cost, compare the three farms using this as CV. What rank do you find for the farms under this definition? Which rank is consistent with the CV discussion from those early class lectures? a. A > B > C b. C > B > A c. C > A > B d. B > A > C 3. What are the 3 correlations for each farms return? (If you did it right, you will find that each correlation is positive.)

1. Which farm has had the highest average return? Which would be the riskiest? What are you basing this on? 2. In an early lecture in this class, we discussed the coefficient of variation (CV in your book, COV in other texts). Thinking of the average return in this problem as a benefit and the standard deviation as the cost, compare the three farms using this as CV. What rank do you find for the farms under this definition? Which rank is consistent with the CV discussion from those early class lectures? a. A > B > C b. C > B > A c. C > A > B d. B > A > C 3. What are the 3 correlations for each farms return? (If you did it right, you will find that each correlation is positive.)

HV5-DATA-H Home Insert Draw Page Layout Fomulas Data Review view JMp Tell me what you want to do Normal Bad A A E Wrap Text A Merge & Center R Conditional Farmat as Good at Painter B I U Neutral Formatting Table A1 0.02996 0.08353 0.10986 199 -0.0 7B8 -0.0183 -0.05338 199 0,01846 0,07188 0,11594 0.0305 10 2001 -0.00217 O.00732M 0.009377 2002 0.002236 0.024882 0.00492 0.0300 0.02419 0.085904 0.054 0.0683 0.0886 201 0,09178 0,05772 -0.0276M 0.02192 -0.00526 0.10298 Sheet1 nsert Delete Farmat Nik Margska AutoSum Sort &

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts