Question: 1. Which of the following statements is CORRECT? One of the advantages of the corporate form of organization is that it avoids double taxation. It

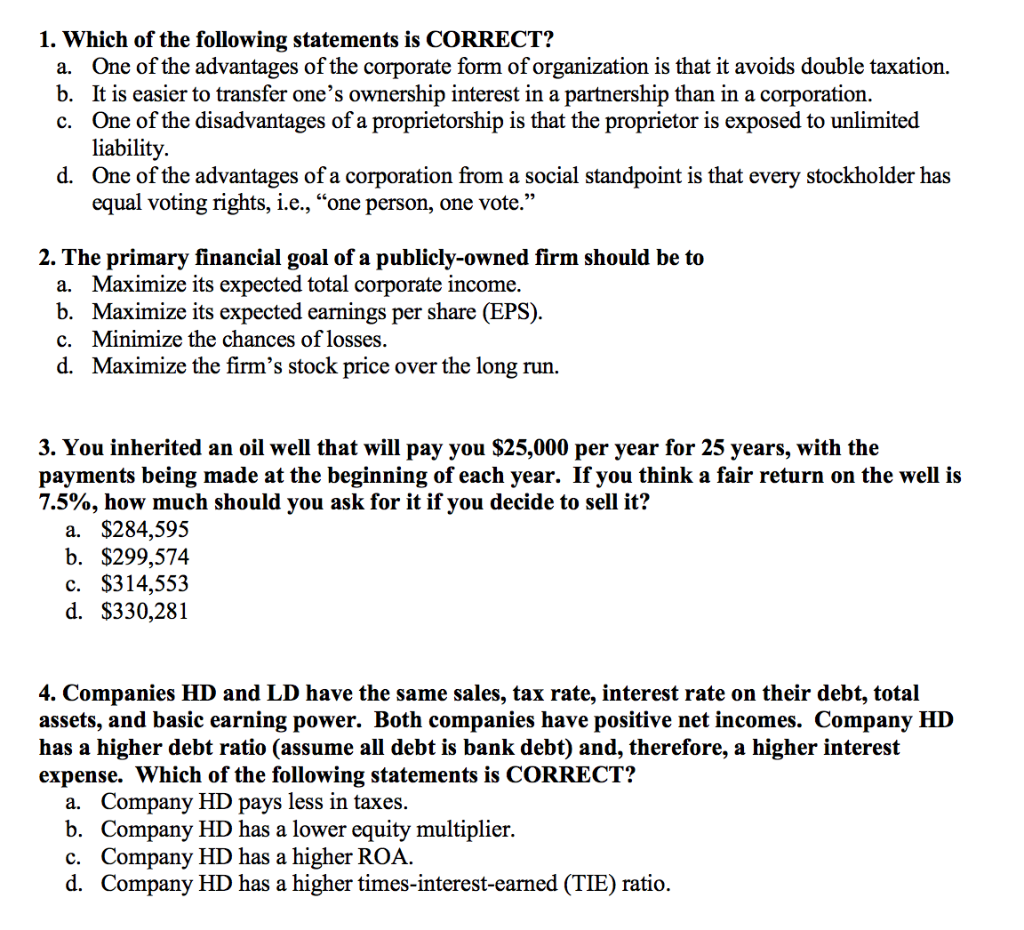

1. Which of the following statements is CORRECT? One of the advantages of the corporate form of organization is that it avoids double taxation. It is easier to transfer one's ownership interest in a partnership than in a corporation. One of the disadvantages of a proprietorship is that the proprietor is exposed to unlimited liability. One of the advantages of a corporation from a social standpoint is that every stockholder has equal voting rights, i.e., "one person, one vote." a. b. c. d. 2. The primary financial goal of a publicly-owned firm should be to Maximize its expected total corporate income. Maximize its expected earnings per share (EPS) Minimize the chances of losses. Maximize the firm's stock price over the long run a. b. c. d. 3. You inherited an oil well that will pay you $25,000 per year for 25 years, with the payments being made at the beginning of each year. Ifyou think a fair return on the well is 7.5%, how much should you ask for it if you decide to sell it? a. $284,595 b. $299,574 c. $314,553 d. $330,281 4. Companies HD and LD have the same sales, tax rate, interest rate on their debt, total assets, and basic earning power. Both companies have positive net incomes. Company HD has a higher debt ratio (assume all debt is bank debt) and, therefore, a higher interest expense. Which of the following statements is CORRECT? Company HD pays less in taxes. Company HD has a lower equity multiplier. Company HD has a higher ROA Company HD has a higher times-interest-earned (TIE) ratio. a. b. C. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts