Question: 1. Which project gives me the most return, what measures communicate this best? IRR? Is a PWI of net revenues/first cost useful for all opportunities?

1. Which project gives me the most return, what measures communicate this best? IRR? Is a PWI of net revenues/first cost useful for all opportunities? Which option(s) have the best annual worth?

2. What budget will I need if I want to move forward with two of the most attractive opportunities? Based on this, what seems to be my MARR based on this round of investment? When should I expect to break-even on the two most attractive opportunities?

Please write out calculations as excel formulas. *NEGLECT inflation.

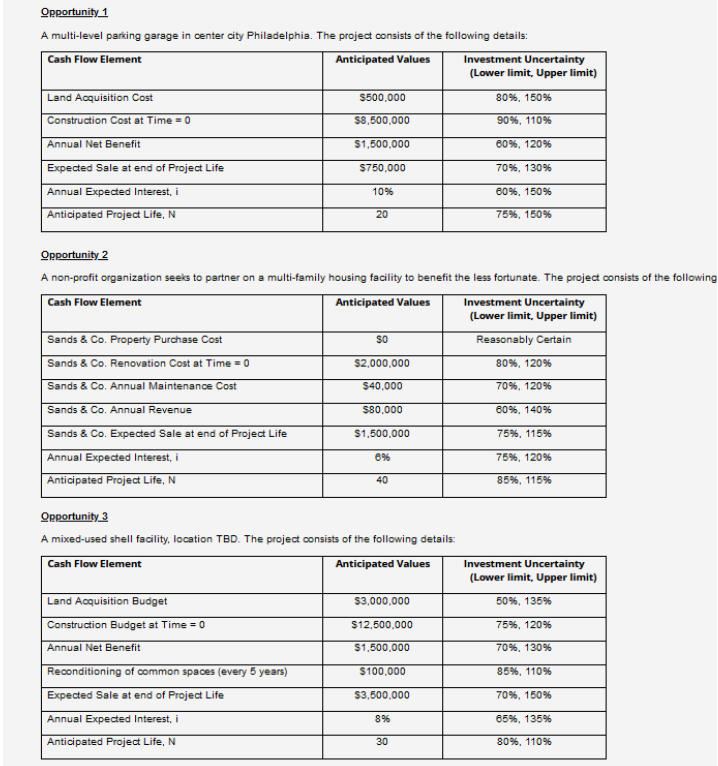

Opportunity 1 A multi-level parking garage in center city Philadelphia. The project consists of the following details: Qpportunity 2 A non-profit organization seeks to partner on a multi-family housing facility to benefit the less fortunate. The project consists of the followi Qeportunity3 A mixed-used shell facility, location TBD. The project consists of the following details: Opportunity 1 A multi-level parking garage in center city Philadelphia. The project consists of the following details: Qpportunity 2 A non-profit organization seeks to partner on a multi-family housing facility to benefit the less fortunate. The project consists of the followi Qeportunity3 A mixed-used shell facility, location TBD. The project consists of the following details

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts