Question: 1. While developing a new product line, Cook Company spent $3 million two years ago to build a plant for a new product. It then

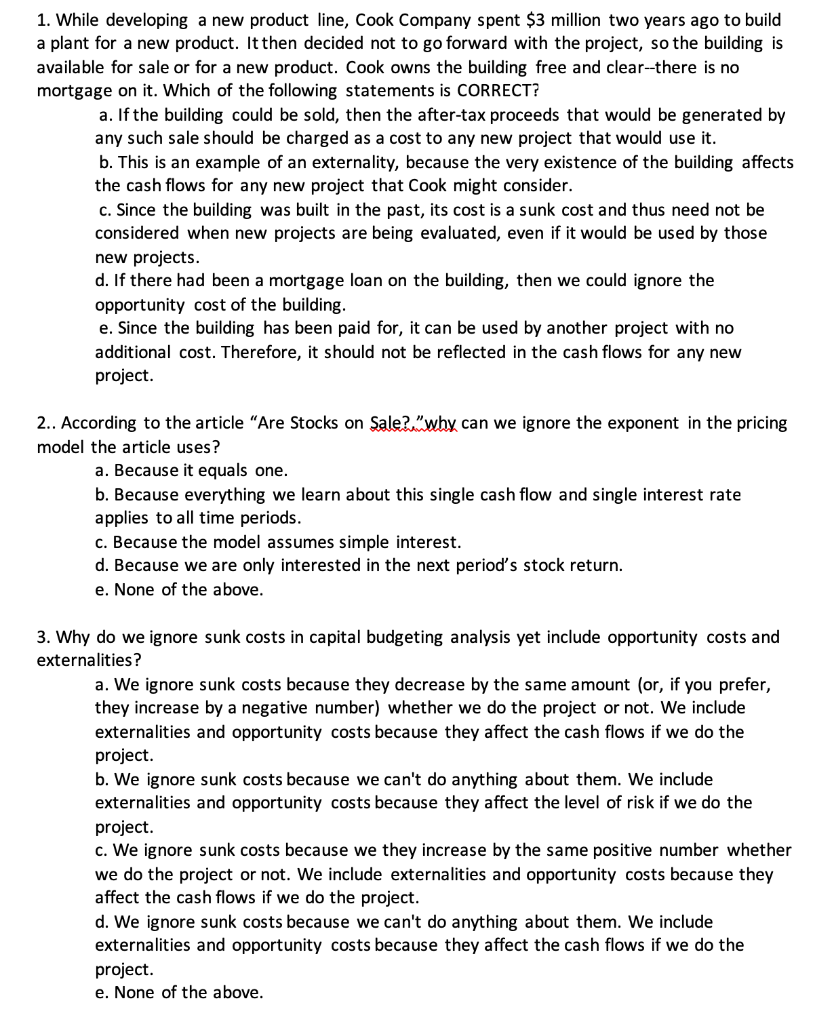

1. While developing a new product line, Cook Company spent $3 million two years ago to build a plant for a new product. It then decided not to go forward with the project, so the building is available for sale or for a new product. Cook owns the building free and clear--there is no mortgage on it. Which of the following statements is CORRECT? a. If the building could be sold, then the after-tax proceeds that would be generated by any such sale should be charged as a cost to any new project that would use it. b. This is an example of an externality, because the very existence of the building affects the cash flows for any new project that Cook might consider. c. Since the building was built in the past, its cost is a sunk cost and thus need not be considered when new projects are being evaluated, even if it would be used by those new projects. d. If there had been a mortgage loan on the building, then we could ignore the opportunity cost of the building. e. Since the building has been paid for, it can be used by another project with no additional cost. Therefore, it should not be reflected in the cash flows for any new project. 2.. According to the article "Are Stocks on Sale2why can we ignore the exponent in the pricing model the article uses? a. Because it equals one. b. Because everything we learn about this single cash flow and single interest rate applies to all time periods. c. Because the model assumes simple interest. d. Because we are only interested in the next period's stock return. e. None of the above. 3. Why do we ignore sunk costs in capital budgeting analysis yet include opportunity costs and externalities? a. We ignore sunk costs because they decrease by the same amount (or, if you prefer, they increase by a negative number) whether we do the project or not. We include externalities and opportunity costs because they affect the cash flows if we do the project. b. We ignore sunk costs because we can't do anything about them. We include externalities and opportunity costs because they affect the level of risk if we do the project. c. We ignore sunk costs because we they increase by the same positive number whether we do the project or not. We include externalities and opportunity costs because they affect the cash flows if we do the project. d. We ignore sunk costs because we can't do anything about them. We include externalities and opportunity costs because they affect the cash flows if we do the project. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts