Question: 1. Why are most current liabilities reported at face or maturity value rather than their present value, as prescribed by GAAP? a. There is no

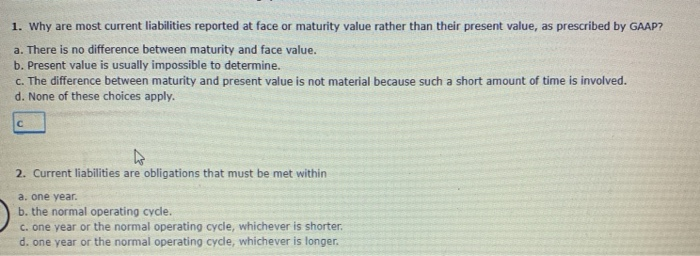

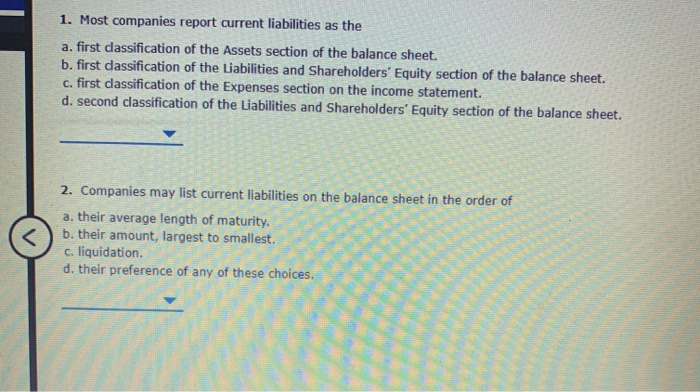

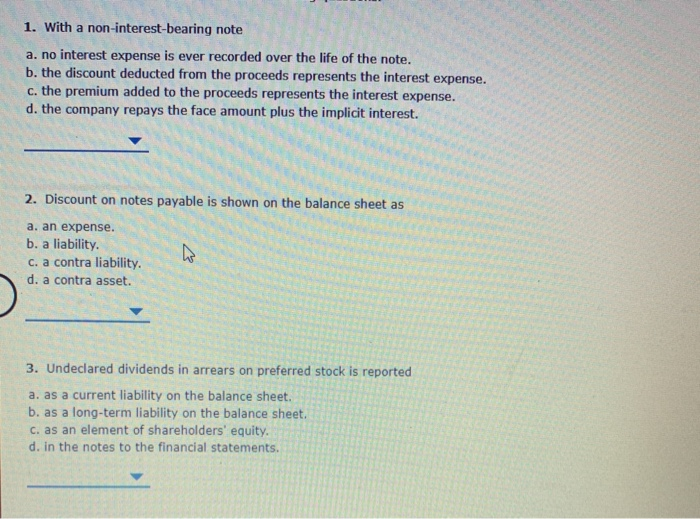

1. Why are most current liabilities reported at face or maturity value rather than their present value, as prescribed by GAAP? a. There is no difference between maturity and face value. b. Present value is usually impossible to determine. c. The difference between maturity and present value is not material because such a short amount of time is involved. d. None of these choices apply. 2. Current liabilities are obligations that must be met within a. one year. b. the normal operating cycle. c. one year or the normal operating cycle, whichever is shorter. d. one year or the normal operating cycle, whichever is longer. 1. Most companies report current liabilities as the a. first dassification of the Assets section of the balance sheet. b. first dassification of the Liabilities and Shareholders' Equity section of the balance sheet. c. first dassification of the Expenses section on the income statement. d. second dassification of the Liabilities and Shareholders' Equity section of the balance sheet. 2. Companies may list current liabilities on the balance sheet in the order of a. their average length of maturity. b. their amount, largest to smallest. c. liquidation d. their preference of any of these choices 1. With a non-interest-bearing note a. no interest expense is ever recorded over the life of the note. b. the discount deducted from the proceeds represents the interest expense. c. the premium added to the proceeds represents the interest expense. d. the company repays the face amount plus the implicit interest. 2. Discount on notes payable is shown on the balance sheet as a. an expense. b. a liability. c. a contra liability. d. a contra asset. 3. Undeclared dividends in arrears on preferred stock is reported a. as a current liability on the balance sheet. b. as a long-term liability on the balance sheet. c. as an element of shareholders' equity. d. in the notes to the financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts